Ever wonder what happens to that small slice of your revenue that disappears every time a customer makes a payment? That's the transaction fee.

Think of it as a toll for using the financial highway. It’s a small percentage or flat rate that a provider, like Stripe or a bank, charges to securely move money from your customer’s pocket into yours.

So, What Exactly Is a Transaction Fee?

Let's say you sell a SaaS subscription for $100. When a customer pulls out their Visa card, that money doesn't just teleport into your business account. It has to travel through a complex web of financial players, and each one takes a tiny piece of the pie for their role. That collection of tiny pieces is the transaction fee.

But what are you actually paying for? It’s more than just a single charge. These fees cover the operational costs, infrastructure, and risks involved in every digital payment. They're what keep the system running smoothly and securely, protecting both you and your customers from headaches.

The Cast of Characters in Every Transaction

Every time a card is swiped or a "buy" button is clicked, a few key players get involved. The transaction fee is what pays them for their part in the show:

- The Customer: The person making the purchase.

- The Issuing Bank: This is the customer's bank, the one that issued their credit or debit card (think Chase or Bank of America).

- The Acquiring Bank: This is your business's bank, the one that accepts the payment on your behalf.

- The Card Network: This is the highway itself—companies like Visa, Mastercard, or American Express that set the rules of the road and connect the banks.

- The Payment Processor: The tech company (like Stripe or PayPal) that acts as the traffic controller, securely connecting everyone and passing the payment data along.

The single fee you see on your statement is really just the bundled cost for all these services. It covers everything from fraud detection and network upkeep to the basic job of moving funds, making sure you get paid without a hitch.

Ultimately, you can't think of transaction fees as just a nuisance. They're simply the cost of doing business online. It’s the price you pay for convenience, security, and access to the global payment infrastructure that allows e-commerce to exist in the first place.

The Hidden Anatomy of Payment Processing Costs

That single transaction fee on your statement looks simple enough, but it’s actually a mashup of several smaller, distinct charges. It’s less like a single toll on a highway and more like an itemized bill from a mechanic—multiple parts and services add up to the final price. If you want to understand where your money is really going, you have to look at the individual components.

For any business, transaction fees are a real expense that can eat into already thin margins. This is especially true for SaaS companies that process a high volume of online payments. The average fee, or "merchant discount rate," usually hovers between 1.5% and 3%, but that figure can easily creep higher for premium rewards cards or international transactions. When you look at the big picture, these small percentages add up to a staggering global cost, which is why founders need to get a handle on every piece of the fee puzzle.

The Core Components of a Credit Card Fee

For most online businesses, credit card fees are the most familiar (and frequent) cost of getting paid. What looks like one charge from your processor is almost always a combination of three separate costs, each going to a different party in the payment chain.

- Interchange Fee: This is the big one, typically making up 70-80% of the total cost. The money goes directly to the customer’s bank (think Chase, Bank of America, or Citi) as compensation for the risk they take in approving the transaction.

- Assessment Fee: This is a much smaller fee paid to the card networks themselves, like Visa or Mastercard. It's essentially their brand fee for letting you use their payment "highways" to move money.

- Processor Markup: This is what your payment processor (like Stripe or PayPal) charges for their service. It’s their cut for providing the technology that connects all the moving parts and makes the transaction happen smoothly.

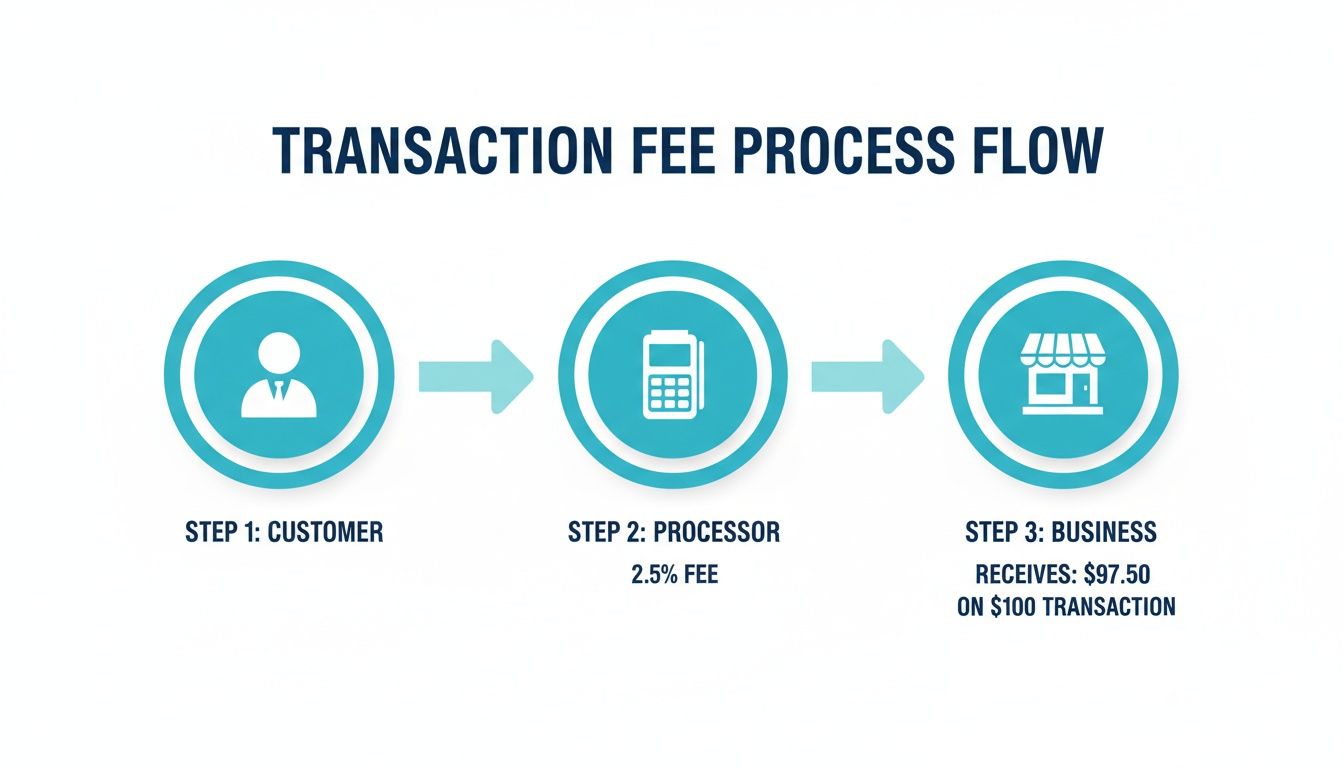

This flow shows how it all comes together. The customer pays, the processor takes its slice, and your business gets what's left.

As you can see, even a small percentage fee takes a noticeable bite out of the revenue that actually lands in your bank account.

Beyond Standard Credit Card Fees

While credit card fees get most of the attention, they’re far from the only game in town. Depending on how you sell and get paid, you’ll run into a whole host of other fee structures.

For a SaaS business, what a transaction fee is depends heavily on where you sell and how you get paid. From app stores to affiliate payouts, each system takes its cut, silently chipping away at your top-line revenue.

Here are a few other common fees you're likely to encounter:

- Bank Transfer Fees (ACH/Wire): These are typically much lower than credit card fees and cover direct bank-to-bank payments. ACH transfers are the slow and steady (and cheaper) option, while wire transfers are fast but cost a premium.

- Marketplace Fees: If you sell your product on a platform like the Apple App Store or Google Play, get ready for a hefty commission. They often charge 15-30% on every single sale and in-app purchase.

- Cryptocurrency Network Fees: In the crypto world, these are often called "gas fees." You pay them to network validators who confirm and record transactions on the blockchain. The cost can swing wildly depending on how busy the network is. This can get even trickier when you're trying to manage multi-currency payment processing.

- Affiliate Platform Fees: Many affiliate management tools charge a percentage of the commissions you pay out to your partners. It's a strange feeling—you're paying a fee on the money you're already paying to someone else.

How to Calculate Your Actual Transaction Fees

It’s one thing to know what a transaction fee is in theory, but it’s another thing entirely to see how it chips away at your own revenue. Getting a handle on the real cost is crucial for accurate financial forecasting and managing your cash flow. Let's break down how the most common pricing models work with some real numbers.

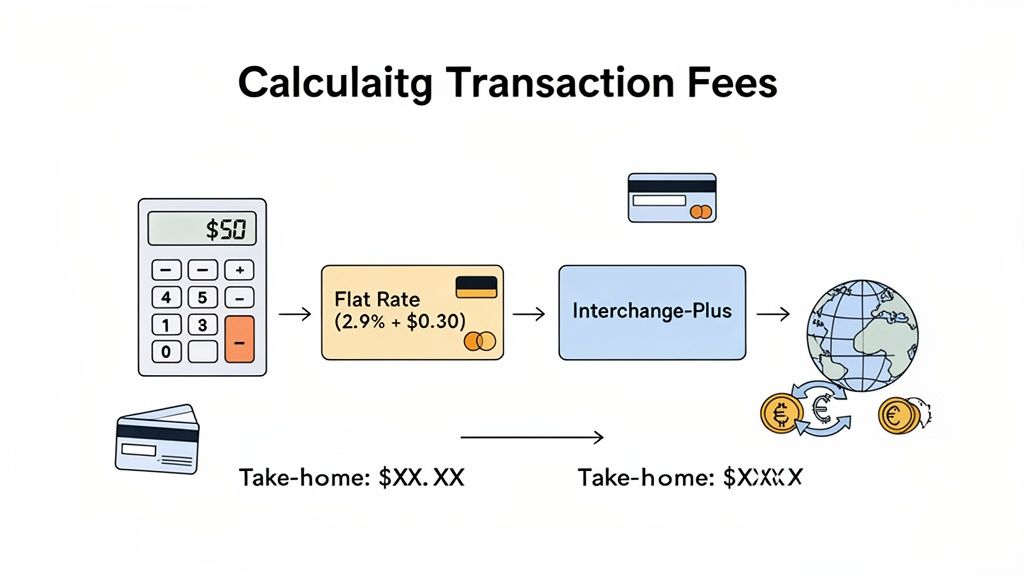

The Simple Flat-Rate Model

The most straightforward approach is the flat-rate model. This is the go-to for payment processors like Stripe and PayPal. They take all the confusing underlying costs—like interchange and assessment fees—and roll them into a single, predictable rate.

A very common flat rate is 2.9% + $0.30 per transaction.

Let’s see how that plays out for a $50 monthly SaaS subscription:

- Calculate the percentage fee: $50.00 x 2.9% (0.029) = $1.45

- Add the fixed fee: $1.45 + $0.30 = $1.75

- Determine your take-home amount: $50.00 - $1.75 = $48.25

This model is popular because it’s so easy to understand. But be warned: that simplicity can come at a cost, especially for businesses with high sales volumes or larger average transaction sizes. If you want to play with the numbers yourself, our Stripe Fee Calculator can give you a quick estimate.

The Complex Interchange-Plus Model

Once your business starts to scale, you might graduate to an interchange-plus model. This pricing structure is far more transparent, but it's also a lot more complicated. Instead of paying one blended rate, you pay the raw "wholesale" interchange fee for each card type, plus a fixed markup to your processor.

A typical interchange-plus rate might look something like Interchange + 0.20% + $0.10.

This model often saves money for larger businesses because the processor's markup is much smaller. However, your monthly statements become much harder to read, with hundreds of different interchange rates appearing as separate line items.

The Added Costs of Going Global

Taking your business international adds another layer of fees to the mix. Cross-border transaction fees can really start to eat into your margins, a common headache for global SaaS companies and affiliate programs.

International transactions made with a credit card often tack on an extra 1-3% fee on top of the usual costs, not to mention 2-3% in FX markups. For a U.S. business, this can push total processing fees into the 2.0-3.2% range, which is roughly $2.34 on a $100 sale.

To see how these fees are calculated on specific platforms, tools like a Cash App fee calculator can be helpful. The more you understand these calculations, the better you'll be at reading your payment statements and building financial models that reflect your true revenue.

Measuring the True Impact on Your SaaS Business

It’s easy to dismiss transaction fees as just another small cost of doing business. But they're much more than a minor line item on a spreadsheet—they're a direct drag on your profitability. Over time, these little fees slowly chip away at your customer lifetime value (LTV) and can seriously limit your growth.

When you stop thinking of fees as a simple operational expense and start seeing them as a key strategic metric, their real impact snaps into focus.

Let's say your SaaS startup just hit a huge milestone: $50,000 in monthly recurring revenue (MRR). Fantastic! But with a standard processing rate of 2.9%, you're losing $1,450 every single month. That adds up to over $17,400 a year vanishing into thin air. That's money that could have funded a new marketing campaign or covered a junior developer's salary.

For businesses that rely on high volume and slim margins, this constant financial leak is even more painful. What seems like a tiny percentage quickly becomes a major roadblock to scaling profitably.

The Silent Drain on Affiliate Programs

Now, let's talk about where transaction fees get really frustrating: affiliate and referral programs. You set these up to motivate partners to bring you new customers, but hidden processing costs can quietly sabotage the very incentive you’re trying to create.

Think about it. When you pay an affiliate their commission, that payout often gets hit with its own transaction fee. You’re essentially getting charged twice—once when the customer pays you, and again when you pay your partner.

This double-dipping is a killer. It's not uncommon for fees to eat up 20-30% of an affiliate's hard-earned commission. The money you intended as a reward for your partners ends up lining the pockets of payment processors, weakening your entire growth engine.

Understanding the Industry Averages

The exact fee you'll pay isn't a fixed number. It can swing quite a bit depending on your industry, business model, and which payment provider you use. For SaaS startups, membership sites, and marketplaces built on recurring revenue, these merchant processing fees have a direct and immediate effect on the bottom line.

For instance, US-based merchants typically pay somewhere between 2.0% and 3.2% for credit card transactions. Stripe famously charges a standard 2.9% plus 30 cents for online payments, while Shopify's rates can vary from 2.4% to 2.9% based on your plan.

And if you’re in a sector considered "high-risk"—like selling certain digital goods—those fees can jump to a painful 3-8%. For a deeper dive into how these rates break down by industry, Clearly Payments has a great analysis. This is why truly understanding what a transaction fee means in your specific context is so critical for smart financial planning.

Actionable Strategies to Reduce Payment Fees

Knowing what transaction fees are is one thing; actually doing something about them is another. While you can't just wish them away, you can take smart, practical steps to soften their blow to your bottom line. It's all about a few key tactics, from simple conversations to strategic platform choices, that help you pocket more of your hard-earned revenue.

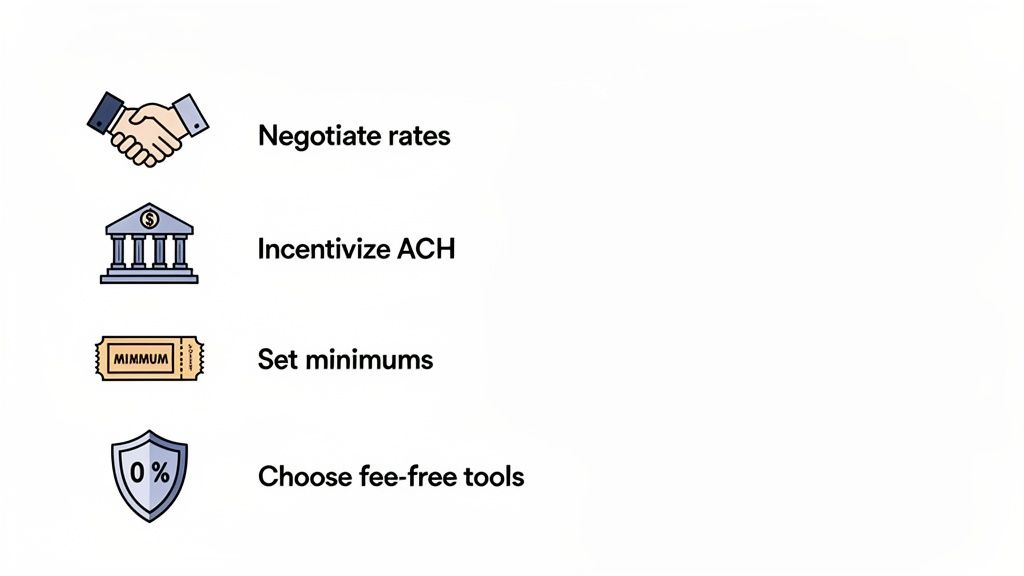

The most direct route? Just ask. As your business grows and your transaction volume climbs, you have more negotiating power than you might think. Don't hesitate to reach out to your payment processor for a rate review. They want to keep high-volume merchants happy and are often open to trimming their markup to keep your business.

Fine-Tuning Your Payment Policies

Beyond direct negotiation, you can subtly guide your customers toward payment methods that cost you less. This usually just means making small, intentional tweaks to your checkout flow and internal policies.

One of the most effective moves is to encourage ACH (Automated Clearing House) transfers. The fees for ACH are a fraction of what you'd pay for credit card processing. By offering a small discount for customers who pay directly from their bank account, you can rack up some serious savings over time. You can learn more about this in our guide on how to set up recurring payments, as ACH is perfect for that model.

Another smart play is setting a minimum transaction amount. This is a game-changer if you deal with lots of small purchases. That fixed $0.30 fee in a "2.9% + $0.30" structure can gobble up your profit on a tiny sale. A minimum purchase ensures every transaction is large enough to absorb that fixed cost, protecting your margins.

To Pass or Absorb: The Big Fee Question

Every business eventually faces this dilemma: do you pass transaction fees on to the customer, or do you eat the cost? Passing it on, or "surcharging," keeps your margins intact but can rub customers the wrong way. Research confirms that unexpected fees at checkout are a major reason people abandon their carts.

Absorbing the fee, on the other hand, treats it like any other cost of doing business. This creates a smoother, more transparent experience for the customer, which can build trust and loyalty—even if it means a slightly smaller profit on each sale.

Deciding how to handle fees is a balancing act. The table below breaks down some of the most common strategies to help you weigh the pros and cons for your business.

Fee Reduction Strategies Comparison

| Strategy | How It Works | Pros | Cons |

|---|---|---|---|

| Negotiate with Processor | Directly ask your payment processor for a lower rate based on your transaction volume. | Simple, direct impact on your bottom line. No changes needed for the customer. | Only effective for high-volume businesses; success isn't guaranteed. |

| Incentivize ACH/Bank Transfers | Offer customers a small discount (e.g., 1-2%) for paying via ACH instead of a credit card. | Significantly lowers processing costs; can build customer goodwill. | Requires educating customers; not all customers will want to use ACH. |

| Set a Minimum Transaction | Require a minimum purchase amount (e.g., $5 or $10) for card payments. | Eliminates profit loss on very small sales where fixed fees are high. | May deter customers making small purchases; can feel restrictive. |

| Absorb the Fee | Treat the transaction fee as a business expense and don't add it to the customer's total. | Creates a seamless, positive customer experience; increases conversion rates. | Directly reduces your profit margin on every single sale. |

| Pass the Fee (Surcharging) | Add a separate line item at checkout to cover the processing fee. | Protects your profit margins completely; makes costs transparent. | Can create friction, reduce conversions, and is legally restricted in some states. |

Ultimately, the right approach depends on your customer base, average order value, and brand identity. A high-end brand might always absorb the fee to maintain a premium feel, while a budget-focused business might pass it on.

Choosing a Fee-Free Future

In the long run, the most powerful strategy is to build your business on platforms designed to sidestep these costs from the start. This is absolutely critical in spaces like affiliate marketing, where every percentage point skimmed by fees is a direct hit to your partners' motivation.

Modern partner management tools let you handle payouts without a middleman taking a cut. Similarly, if you run events, looking into alternatives to Eventbrite that don't chip away at your ticket revenue can make a world of difference. When you choose platforms with flat-rate subscriptions instead of per-transaction fees, your costs stay predictable. You're no longer punished for your own success.

Why the Future of SaaS Growth Is Fee-Free

Something interesting is happening in the SaaS world. The old playbook of charging a percentage-based transaction fee on every sale is starting to look outdated. We're seeing a clear shift towards simple, flat-rate subscription models.

Why the change? It's a move away from what you could call "parasitic pricing"—where a tool's success is tied directly to taking a slice of its users' revenue.

This is a huge deal for anyone running a partnership or affiliate program. Think about it: when your platform skims a percentage off every single payout, it puts you at odds with your own partners. Your best advocates feel the pinch of smaller commissions, and you essentially get penalized for running a successful program that's generating more revenue. It just doesn't make sense.

A New Model for Partnerships

Thankfully, there's a better way. Modern tools are now designed to be embedded directly into your own product. This lets you manage, track, and pay partners seamlessly, without some third-party platform taking a cut from every transaction.

Choosing a tool with a 'no transaction fee' philosophy isn't just about saving money—it's a massive strategic advantage. It means your growth efforts actually fuel your bottom line, not someone else's.

This completely changes the conversation around transaction fees. Instead of accepting them as a necessary evil, you can treat your partnership software like any other tool: a predictable, fixed cost.

Take a platform like Refgrow, for instance. It runs on a straightforward monthly subscription. This means you could scale your affiliate revenue from $1,000 to $100,000 a month, and your platform fee wouldn't change by a single dollar. Your success is actually your success, which helps build a much healthier and more motivated partner ecosystem for the long haul.

Frequently Asked Questions

When you're trying to grow a SaaS business, the details around transaction fees can feel a little fuzzy. Here are some quick, straightforward answers to the questions we hear most often.

Can I Completely Avoid Transaction Fees?

Honestly, it's pretty rare to get rid of them entirely. If you're accepting payments, there's almost always a cost involved somewhere along the line.

But you can make smart choices to eliminate them in specific areas. For instance, some modern affiliate program platforms have ditched the old percentage-based model. Instead, they charge a flat subscription, which means they don't take a cut of your partner payouts. That simple change can save you a fortune as your program grows, so you aren't punished for your own success.

Are Fees Different for B2B vs. B2C SaaS?

Absolutely. The fee structures can look completely different. B2C SaaS usually means tons of smaller, recurring credit card payments. For that, simple flat-rate processing fees are the norm.

B2B, on the other hand, is a different beast. You're often dealing with:

- Larger Invoice Amounts: We're talking transactions that can easily run into the thousands of dollars.

- Varied Payment Methods: It's not just consumer credit cards. You'll see corporate cards, ACH transfers, and even wire transfers.

- Distinct Fee Structures: Wire transfers come with hefty flat fees, while corporate cards often have higher interchange rates than personal ones.

Because of this, B2B founders have to pay much closer attention to how their clients are paying to keep costs under control.

The big takeaway here is that your business model dictates the kind of transaction fees you'll face. A high-volume B2C company worries about different costs than a high-touch B2B enterprise.

How Should I Account for Fees in Financial Planning?

The best way to handle this is to treat transaction fees as a variable cost of goods sold (COGS). Think of them as a direct cost of doing business—you have to pay them to make a sale and deliver your service.

When you model fees as a direct percentage of revenue in your financial forecasts, you get a much clearer picture of your actual net profit and gross margins. This isn't just another line-item expense; it's a critical metric that helps you make smarter decisions about pricing, profitability, and the true cost of each transaction.

Ready to grow your affiliate program without getting hit by endless transaction fees? Refgrow offers a powerful, embeddable solution with zero fees on your partner payouts.