At its core, setting up recurring payments means creating a system that automatically bills your customers at set intervals for access to your SaaS. This usually involves picking a payment processor like Stripe or LemonSqueezy, hooking it into your product, setting up your subscription tiers, and using webhooks to keep track of everything—especially those all-important affiliate commissions.

Why Mastering Recurring Payments Is Critical For Growth

Before we get into the nitty-gritty, let's zoom out. A slick recurring payment system isn't just a backend task to check off your list; it's a strategic weapon. For any SaaS founder, predictable revenue is the holy grail. A well-oiled billing machine is what makes that predictability a reality, and it touches every single growth metric you care about.

When payments just work, it creates a ripple effect of good things. You'll see a drop in involuntary churn from failed payments, which directly pumps up your Customer Lifetime Value (CLV). This consistency also solidifies your Monthly Recurring Revenue (MRR), making your financial forecasts something you can actually rely on.

We've got a whole guide on this, so be sure to check out our post on how to calculate monthly recurring revenue: https://refgrow.com/blog/calculate-monthly-recurring-revenue.

The Foundation Of Affiliate Trust And Scale

This reliability is even more crucial when you're running an affiliate program. Your affiliates aren't just partners; they're an extension of your growth team. Their trust is everything, and that trust is built on one simple promise: getting paid accurately and on time for the business they send your way.

A solid recurring payment setup guarantees that every single subscription renewal they generate is tracked, attributed, and credited correctly. No excuses.

When an affiliate sees those commissions roll in automatically every month, their confidence in your program soars. That trust is the fuel for a scalable affiliate strategy, motivating them to double down on promoting your product.

Automating commission tracking with a platform like Refgrow pulls human error and admin headaches out of the equation. It creates a powerful, self-sustaining growth loop: motivated affiliates drive more recurring revenue, which in turn funds more commissions, creating a predictable and scalable way to acquire new customers.

This table breaks down exactly how a smooth payment process directly impacts the metrics you and your affiliates care about most.

Impact of Recurring Payments on Core SaaS Metrics

| SaaS Metric | Impact of Effective Recurring Payments | Why It Matters for Your Affiliate Program |

|---|---|---|

| Customer Lifetime Value (CLV) | Increases CLV by reducing involuntary churn from failed payments. | Higher CLV means affiliates earn more from each referral over time, making your program more attractive. |

| Monthly Recurring Revenue (MRR) | Stabilizes and grows MRR, providing a predictable revenue stream. | Stable MRR gives you the financial confidence to offer competitive, recurring commissions. |

| Customer Churn Rate | Directly lowers churn by automating payment retries and updates. | Lower churn means more renewals, which translates to more recurring commissions and happier affiliates. |

| Affiliate Payout Accuracy | Ensures 100% accuracy in tracking and attributing renewal commissions. | Eliminates payment disputes and builds the trust needed for affiliates to invest heavily in promotion. |

In short, getting this right isn't just about keeping the lights on—it's about building a foundation that your entire growth strategy, especially your affiliate program, can build upon.

The Bigger Economic Picture

The move to subscription-based business models isn't just a trend; it's a fundamental economic shift. The global recurring payments market is on track to hit an incredible USD 261.36 billion by 2029. In fact, the subscription economy has been growing nearly six times faster than the revenues of S&P 500 companies since 2012.

Nailing your billing isn't just a technical challenge. It's your entry pass to this massive economic wave. To really make the most of it, you'll want to layer in some smart data-driven growth marketing strategies.

Choosing Your Payment Gateway: Stripe vs. LemonSqueezy

Picking your payment gateway is a foundational decision that will shape your business for years. It’s not just about collecting money; this choice is the very engine of your entire revenue operation. When you're figuring out how to set up recurring payments, the conversation almost always lands on two fantastic, but very different, contenders: Stripe and LemonSqueezy.

The Case for Stripe: Total Control

Stripe is the undisputed heavyweight champion in the payments world, famous for its powerful, developer-first API. It offers an incredible amount of control and flexibility. If your team is itching to build a deeply custom billing experience, juggle complex subscription logic, or weave payments into an already intricate system, Stripe is probably your best bet. Think of it as a professional-grade toolkit for engineers who want to sculpt every single detail of the payment flow.

But with great power comes great responsibility. When you use Stripe, you become the Merchant of Record. This is a critical detail. It means you are legally on the hook for calculating, collecting, and remitting sales tax and VAT across the globe. For a small team or a solo founder, this can quickly spiral into a full-time compliance nightmare.

The LemonSqueezy Alternative: Simplicity and Peace of Mind

This is exactly where LemonSqueezy shines with a completely different philosophy. LemonSqueezy steps in to act as your Merchant of Record, taking the entire burden of global tax compliance off your shoulders. They manage the tangled web of sales tax, VAT, and other international regulations for you. For any business aiming to sell worldwide without an in-house tax department, this is a massive weight lifted.

This "done-for-you" model is a magnet for indie founders and small SaaS teams. It frees you up to pour all your energy into building a great product and finding customers, knowing the financial red tape is already handled.

For a SaaS business plugging into an affiliate platform like Refgrow, this simplification is a game-changer. Both gateways connect beautifully via webhooks, but the day-to-day operational load on your team is worlds apart.

So, Which One is Right for You?

The best choice really hinges on your business's current stage and available resources. There’s no single right answer, only what’s right for you.

Here’s a simple way to look at it:

Go with Stripe if: You have a development team ready to build and maintain a custom billing system. You need absolute control over the checkout flow and are prepared to manage complex billing scenarios and tax compliance internally.

Go with LemonSqueezy if: You're a solo founder or small team focused on speed and simplicity. The idea of navigating global sales tax gives you a headache, and you’d much rather have an all-in-one solution that just works out of the box.

Both platforms fire off the necessary webhook events for a seamless affiliate integration. When a subscription starts, changes, or gets canceled, a webhook lets systems like Refgrow know, so commissions can be tracked accurately and automatically.

If you're leaning towards LemonSqueezy, we have a complete walkthrough available. You can find it in our guide for setting up LemonSqueezy with Refgrow.

Ultimately, you're weighing total customization (Stripe) against operational freedom (LemonSqueezy). Choose the path that lets you focus on what you do best.

Connecting Your Payment Gateway to Your Affiliate System

Okay, you've picked your payment gateway. Now comes the crucial part: building the bridge between your revenue engine and your affiliate program. This connection is what turns a customer's payment into an affiliate's commission. It’s a bit technical, but the logic is simple. You're basically telling your payment gateway to ping your affiliate platform every time a payment-related event happens.

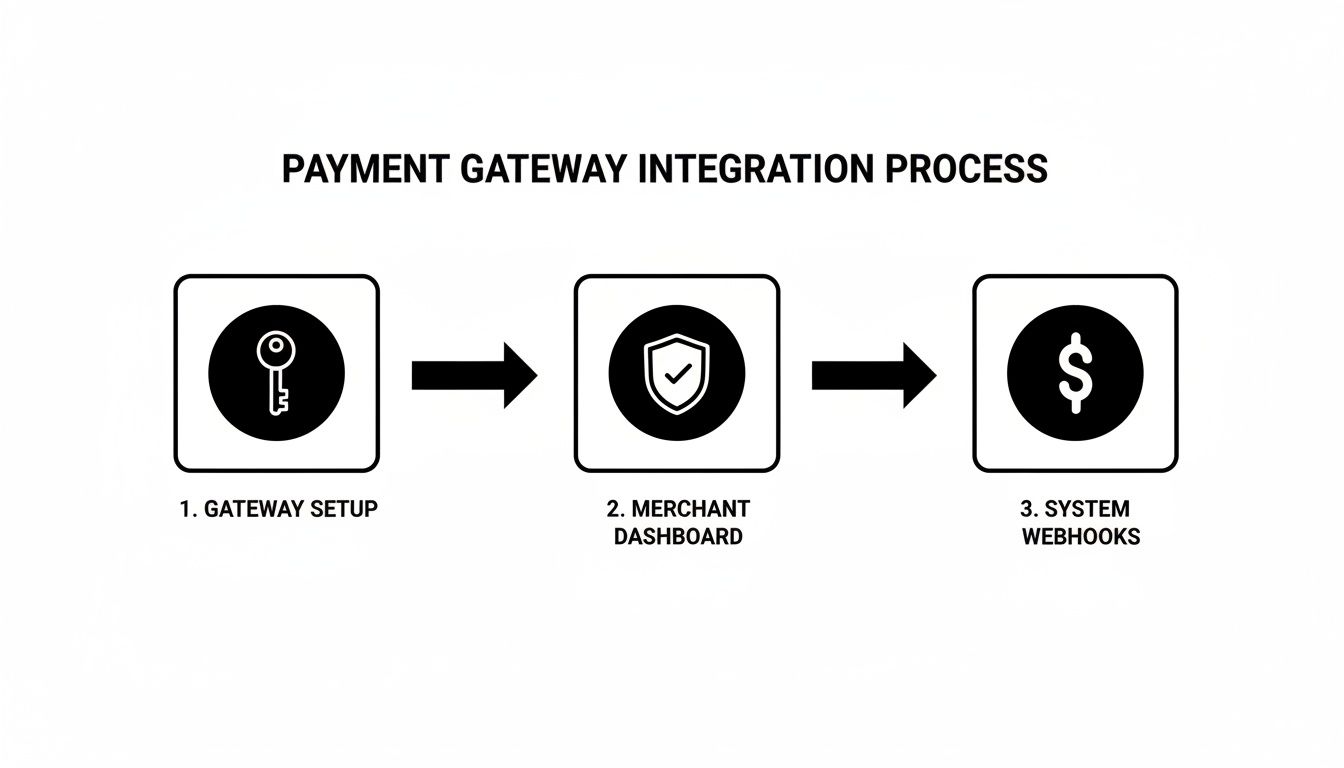

The whole thing works because of two key pieces: API keys and webhooks.

Think of an API key as a secure password that lets your affiliate platform (like Refgrow) properly identify itself to your payment gateway. A webhook, on the other hand, is like a dedicated hotline that your gateway uses to send real-time alerts about things like new subscriptions or successful renewals. Getting this right is what makes a recurring commission program trustworthy and, most importantly, frees you from manual tracking.

Generating and Securing Your API Keys

First things first, you need to generate API keys from your payment gateway’s dashboard. Whether you're using Stripe or LemonSqueezy, you'll find a developer section where you can create them. You’ll get two kinds of keys: a publishable key (which is safe to use on the front-end of your website) and a secret key.

That secret key is the one we care about for this integration. Seriously, treat it like the keys to your castle—it should never be exposed publicly. This is the key you’ll securely paste into your affiliate platform’s settings.

Here’s what that looks like in the Refgrow dashboard. It’s designed to be a simple copy-and-paste job, creating a secure handshake between the two systems without you having to touch a line of code.

Once you save the API key, your affiliate platform can start talking to your payment gateway. But right now, it's a one-way conversation. To close the loop, we need to set up the notification system—the webhooks.

Configuring Webhooks for Real-Time Events

Webhooks are the absolute lifeblood of automating recurring affiliate commissions. They're just automated messages sent from one app to another when something specific happens. In our world, the "app" is your payment gateway, and the "something" is a successful subscription payment, a refund, or a cancellation.

Your affiliate platform will give you a unique webhook URL. Your job is to grab that URL and plug it into the webhooks section of your payment gateway's dashboard. This tells the gateway, "Hey, anytime one of these specific events happens, send all the details to this address."

My Two Cents: You don't need to listen for every single event your payment gateway offers. That’s just noise. Focus only on the ones that directly impact commissions to keep your system clean and efficient.

So, which events actually matter for tracking affiliate commissions? From my experience, you'll want to focus on these core few:

- Initial Sale: For Stripe, this is

checkout.session.completed. For LemonSqueezy, it'sorder_created. This fires when a customer makes their very first payment, officially linking that new subscription to the referring affiliate. - Recurring Payment: This is the big one. It's

invoice.payment_succeededin Stripe andsubscription_payment_successin LemonSqueezy. This event fires every single time a successful renewal payment goes through, triggering the recurring commission. - Subscription Canceled: On Stripe, look for

customer.subscription.deleted. On LemonSqueezy, it’ssubscription_cancelled. This tells your system when a customer churns, which automatically stops any future commissions for that referral. - Refunds: If you have to refund a payment,

charge.refunded(Stripe) ororder_refunded(LemonSqueezy) lets your affiliate system automatically claw back the commission tied to that payment.

By setting up webhooks for these key events, you build a fully automated machine. An affiliate drives a sale, the initial webhook fires, and the first commission lands. A month later, the subscription renews, the renewal webhook fires, and the next commission is credited automatically. No spreadsheets, no manual checks, and no disputes. This is how you build a recurring payment system that creates lasting trust with your partners.

Structuring Subscription Plans And Commission Rules

Alright, with the technical heavy lifting out of the way, it's time to shift gears from engineering to strategy. The way you structure your commission rules is every bit as important as the webhooks that make them work. This is where you bake the business logic into your affiliate program—the logic that truly motivates your partners and fuels your growth.

The heart of this process is mapping your subscription plans to specific commission rules. It’s not about just slapping a flat percentage on everything and calling it a day. You need to think critically about how each rule aligns your affiliates' incentives with your own business goals, whether that's boosting Monthly Recurring Revenue (MRR) or maximizing customer lifetime value.

This whole process is a smooth flow of information between your payment gateway, your dashboard, and your system.

The key thing to see here is how seamlessly data moves—from the moment a payment is made to the webhook event that triggers the commission, all managed right from your dashboard.

Designing Effective Commission Models

When it comes to commission structures, there's no single magic formula. The best model for your SaaS really depends on what behavior you want to drive.

Are you trying to get a flood of new sign-ups as quickly as possible? A higher, one-time commission on the very first payment could be your best move. This approach front-loads the reward, giving affiliates a powerful and immediate reason to push traffic and get those conversions.

But if your main goal is to attract high-value customers who will stick around for the long haul, a lifetime recurring commission is an absolute game-changer. Offering a percentage of every single renewal payment for the entire life of the customer is the ultimate win-win.

A lifetime recurring commission turns your affiliates into true partners. They're no longer just focused on the initial sale; they're invested in finding customers who will stick around, reducing churn and growing your MRR.

It's always a smart move to see what others are doing successfully. Checking out the top recurring commission affiliate programs can give you some fantastic ideas and benchmarks for your own structure.

Tying Rules to Specific Subscription Tiers

Here’s a powerful strategy I've seen work time and again: create different commission rules for your different subscription plans. This lets you financially reward affiliates for bringing you customers who sign up for your most valuable tiers.

Let's walk through a real-world scenario for a SaaS with a couple of plans:

- Basic Plan ($29/month): You might offer a solid 20% recurring commission. That's an attractive, standard rate for your entry-level product.

- Pro Plan ($99/month): Now for the premium plan, you could sweeten the deal with a more generous 30% recurring commission.

This tiered setup creates a crystal-clear financial incentive. An affiliate earns just $5.80 per month for a Basic referral, but they earn a much more substantial $29.70 per month for a Pro referral. All of a sudden, they have a very compelling reason to create content, tutorials, and campaigns that specifically showcase the benefits of your premium features.

This is how you transform your affiliate program from a basic referral system into a strategic sales channel. By aligning the rewards with your most profitable plans, you empower your partners to actively help you scale the business and increase your average revenue per user. Getting this part of how to set up recurring payments right is absolutely essential.

Building Lasting Trust by Automating Affiliate Payouts

Now for the final piece of the puzzle—and honestly, it's the most critical part for keeping your affiliates happy: paying them. On time. Every single time. This is where automation stops being a "nice-to-have" and becomes the foundation of trust in your program.

When you get your recurring payment webhooks dialed in correctly, you completely remove the manual busywork and the inevitable human errors that come with it. It’s this automation that truly cements your partnership.

Affiliates depend on predictable income. When they see those recurring commissions hit their dashboard consistently each month, it's proof that you run a professional, reliable program. That confidence is what motivates them to double down and put more of their own resources into promoting your SaaS.

The market has already paved the way for this. Consumer habits have shifted, with 72% of subscription businesses now mixing recurring plans with one-time purchases. This widespread acceptance of automatic payments means your affiliate commission structure will feel natural and expected. You can dig into more of this data over at Cashfree.

Dialing In Your Payout Schedule

Okay, so commissions are tracking properly. The next step is to decide when and how your affiliates get paid. This isn't just some minor detail; it’s a core component of your affiliate agreement. A really common—and fair—approach is to use a NET-30 schedule.

This simply means that all commissions an affiliate earns in one month, let's say January, become ready for payout 30 days after that month closes out. So, January's earnings would be paid at the beginning of March.

Why the 30-day buffer? It's standard practice for a couple of very important reasons:

- It covers refunds. This window gives you time to process any refund requests or deal with chargebacks before you pay out a commission on money that you didn't actually keep.

- It keeps your books clean. Batch-processing an entire month's worth of payouts at once makes accounting so much simpler.

To an affiliate, a clear and consistent schedule like NET-30 signals that you're running a mature, well-organized program. It eliminates guesswork and sets clear expectations—which is absolutely essential for building a long-term, trusting relationship.

Mass Payouts or Manual Approvals?

Modern affiliate platforms like Refgrow give you the final say on how payouts are processed. You generally have two main options, each with its own advantages.

Mass Payouts: This is your set-it-and-forget-it, most efficient choice. You can pay all of your eligible affiliates with a single click. The system does the heavy lifting, calculating who is owed what based on your NET-30 rules and sending the payments. To get a better look at how this works, you can learn more about affiliate payment automation in our guide.

Manual Approval: If you're the kind of person who likes to have a bit more oversight, you can choose to review each individual payout before it goes out. This can be especially useful when you're just starting your program or if you want to personally verify the commissions for a top-tier partner.

At the end of the day, automating your payouts is how you build a program that can scale. It transforms what could be a massive logistical headache into one of your best tools for retaining your most valuable partners.

Got Questions About Recurring Commissions? We've Got Answers.

Even with the smoothest setup, a few questions are bound to come up. Getting the details right on recurring payments is what separates a good affiliate program from a great one. Let's dig into some of the most common things we hear from SaaS founders.

Can I Offer Different Commission Rates for My Pricing Tiers?

You bet. In fact, you absolutely should. A flexible platform like Refgrow is built for this. You can easily create unique commission rules for every single subscription plan you have.

Think about it: you could offer a solid 20% recurring commission on your entry-level "Basic" plan, but then bump that up to a more enticing 30% recurring commission for your "Pro" plan. This is a brilliant strategy. It gives your top affiliates a real financial reason to push your most valuable plans, tying their success directly to your MRR growth.

What Happens When a Customer Upgrades or Downgrades?

This is where your webhook integration really proves its worth. Because your payment processor is talking directly to your affiliate platform, any changes to a subscription are handled instantly and automatically. No manual work needed.

So, when a customer upgrades to a pricier plan, the affiliate's recurring commission gets a bump to match the new subscription value.

This automatic adjustment is a game-changer. It keeps everything fair and accurate, ensuring your affiliates are always paid based on the actual revenue they're bringing in right now.

The same thing happens in reverse. If a customer downgrades to a cheaper plan, the commission is adjusted down accordingly. This creates a perfect, closed-loop system where commissions always reflect the current MRR for that referral. It keeps your books clean and your affiliate partnerships built on trust.

How Do You Handle Refunds and Chargebacks?

This is a big one, and it's all about protecting your business. When a customer's payment is refunded or hit with a chargeback, the webhook for that event fires off and tells your affiliate system immediately.

The system then automatically voids or claws back the commission that was generated from that specific payment from the affiliate's pending balance.

This is a standard and essential safeguard. It ensures you’re never paying out commissions on money you didn't actually keep. This protects your cash flow and maintains the financial integrity of your program. Any professional affiliate will understand and expect this—it's just good business.

Ready to build an affiliate program that feels like a core part of your SaaS? Get started with Refgrow and see just how simple it is to set up, track, and automate recurring commissions that scale with you. See how it works at https://refgrow.com.