So, what exactly is customer lifetime value (CLV)? In simple terms, it’s the total amount of money you can reasonably expect to make from a single customer over the entire time they're with you. It’s a metric that looks forward, shifting your focus from a single sale to the long-term health and profitability of your customer relationships.

Think of CLV as the North Star for your SaaS business. It's the one metric that keeps you pointed toward truly sustainable growth.

Why Customer Lifetime Value Is Your SaaS North Star

Let's be real for a moment. Vanity metrics like new sign-ups or daily active users can give you a nice ego boost, but they don't actually pay the bills. They capture a fleeting moment, not a lasting relationship. A great SaaS company isn’t built on a huge volume of one-and-done users who churn out after a month. It’s built on a foundation of relationships that generate predictable, recurring revenue for years to come.

This is where customer lifetime value analysis shines. It cuts through the noise to answer the most important question: "What is a customer really worth to us over their entire journey?"

Instead of obsessing over acquisition numbers alone, CLV forces you to see the bigger picture. It connects the dots between your marketing budget, your product roadmap, and your customer success efforts, tying them all directly to your bottom line.

The Problem with Short-Term Metrics

Relying only on metrics like Monthly Recurring Revenue (MRR) or total user count can be dangerously misleading. A big spike in sign-ups might look amazing on a chart, but it can easily hide some serious problems just beneath the surface.

Are those new customers actually sticking around? Are they upgrading to higher-tier plans? Or are you just pouring marketing dollars into a leaky bucket, where new customers come in one door as fast as old ones leave out another?

A high churn rate will wipe out even the best acquisition efforts. It creates a treadmill effect where you’re working incredibly hard just to stand still. Focusing on CLV is how you finally step off that treadmill.

By measuring CLV, you can find your best customers, keep them longer, and make more money over time. It shifts the entire company’s focus from simply acquiring users to nurturing valuable, long-term relationships that fuel sustainable growth.

How CLV Guides Smarter Decisions

Understanding your CLV isn’t just about having another number for your dashboard—it completely changes how you run your business. It becomes your strategic GPS, guiding every major decision you make. Once you know what a truly loyal customer is worth, you can invest confidently in the things that create more of them.

Here’s how a proper customer lifetime value analysis sharpens your strategy:

- Smarter Marketing Spend: It tells you exactly how much you can afford to spend to acquire a new customer (your Customer Acquisition Cost, or CAC) and still turn a healthy profit. No more guesswork.

- Product Roadmap Prioritization: By seeing which features your highest-value customers love and use the most, you know precisely where to invest your precious development time.

- Improved Retention Efforts: CLV helps you spot at-risk customers early on and gives you the data you need to justify spending on customer support and success initiatives that keep people around.

- Sustainable Growth: It fundamentally shifts your business model away from chasing short-term wins and toward building a solid base of loyal, high-value customers who provide reliable, predictable revenue.

The Core Formulas for Calculating Customer Lifetime Value

Diving into customer lifetime value calculations can feel like you need a degree in data science, but you really don't. At its core, CLV analysis is about using a few key formulas to turn customer behavior into clear financial insights. The trick is simply knowing which formula to use and when.

You’ll generally see two main flavors of CLV: historical and predictive. Historical CLV looks backward, adding up what a customer has already spent. Predictive CLV, as the name suggests, looks forward to forecast how much they will spend. For a forward-thinking SaaS business, predictive models are where the real power lies, but you have to start somewhere.

Starting with the Simple CLV Formula

The most straightforward entry point into customer lifetime value analysis is the simple, historical formula. Think of it as a quick snapshot of the value your average customer has brought in so far. It’s a fantastic starting point for taking your business’s financial pulse.

Here’s the basic formula:

Simple CLV = (Average Purchase Value) x (Average Purchase Frequency Rate) x (Average Customer Lifespan)

Let's put some real numbers to that. Imagine your SaaS business charges an average of $50 per month. Your customers make 12 "purchases" a year (one monthly payment), and they tend to stick around for 3 years on average.

The math is pretty simple:

- Simple CLV = $50 x 12 x 3 = $1,800

What does that $1,800 tell you? It means that, on average, a new customer will generate $1,800 in total revenue over their entire relationship with your company. It’s a clean, simple metric that gives you an immediate sense of what a customer is worth.

Advancing to the Traditional CLV Formula

Simple CLV is a great start, but it has a big blind spot: it ignores profitability. It only shows you the revenue, not the actual profit left over after your costs. The traditional formula fixes this by adding one crucial ingredient—your gross margin.

This gives you a much more grounded view of a customer's true financial impact.

The formula is a slight variation of the first:

Traditional CLV = (Average Purchase Value x Average Purchase Frequency Rate) x Gross Margin x Average Customer Lifespan

To use this, you’ll first need to calculate your Gross Margin Percentage. It's just (Total Revenue - Cost of Goods Sold) / Total Revenue. Let's say your SaaS business runs at a healthy 80% gross margin.

Plugging that into our previous example, we get:

- Traditional CLV = ($50 x 12) x 0.80 x 3 = $1,440

See the difference? This $1,440 is a far more honest number. It shows that after covering the costs to deliver your service, the average customer contributes $1,440 in pure profit. This is the number you should be comparing against your customer acquisition costs. If you need a refresher, check out our guide on how to calculate customer acquisition cost.

Key Metrics for CLV Calculation

Before moving on to more advanced models, it helps to have a clear understanding of the building blocks. These are the core metrics you'll need to pull from your data, whether you're using a simple spreadsheet or a sophisticated analytics tool.

| Metric | What It Measures | Why It's Important |

|---|---|---|

| Average Purchase Value (APV) | The average amount a customer spends in a single transaction. For SaaS, this is often the monthly or annual subscription fee. | This is the fundamental unit of revenue per customer. Increasing it directly boosts CLV. |

| Average Purchase Frequency (APF) | How often a customer makes a purchase within a specific time period (e.g., 12 times a year for a monthly subscription). | Measures customer engagement and loyalty. Higher frequency means a more stable revenue stream. |

| Average Customer Lifespan (ACL) | The average length of time a customer remains active before they churn. Usually measured in months or years. | This determines the duration over which you can collect revenue. Reducing churn is key to extending lifespan. |

| Gross Margin | The percentage of revenue left after subtracting the Cost of Goods Sold (COGS). For SaaS, COGS includes hosting, support, etc. | This translates revenue into actual profit, giving you a realistic view of a customer's financial contribution. |

| Churn Rate | The percentage of customers who cancel their subscriptions in a given period (e.g., per month). | The inverse of customer lifespan. It's a critical health metric for any subscription business. |

Understanding these components individually is the first step toward mastering the CLV calculation and, more importantly, figuring out which levers to pull to improve it.

Why Predictive Models Are the Future

Historical formulas are solid for getting a baseline, but they operate on one big, risky assumption: that the future will look exactly like the past. This is where predictive models come in. They provide a much more dynamic and forward-looking view by actively accounting for things like churn.

A common predictive formula looks something like this:

Predictive CLV = ((Average Monthly Recurring Revenue per Customer x Gross Margin) / Monthly Churn Rate)

This model is a game-changer for SaaS companies because it puts churn—the ultimate subscription killer—right at the center of the calculation. It helps you see how even small changes in retention can have a massive impact on lifetime value.

For a deeper look into the mechanics, it’s worth exploring the customer lifetime value calculation formula that many modern startups rely on. By getting comfortable with both historical and predictive approaches, you can make smarter, data-driven decisions that truly move the needle.

Gathering the Right Data for Accurate CLV Analysis

Your CLV analysis is only ever as good as the data you feed it. Garbage in, garbage out. Think of it this way: if your data is flawed, you're essentially making critical business decisions with a distorted map. You might think you're heading toward your most valuable customers when you're actually chasing phantoms.

This is why building a clean, reliable data pipeline isn't just a job for the tech team—it's a core business strategy. The whole point is to turn a messy jumble of raw information into a clear, actionable asset that lets you forecast accurately and invest in growth wisely.

Pinpointing Your Essential Data Sources

To get started with CLV, you'll need to pull information from a few different corners of your business. Each source gives you a crucial piece of the puzzle. When you put them all together, you get a complete picture of your customer's journey and their financial impact over time.

For a really solid analysis, you need the ability to pull and process large volumes of customer data, which is where tools like AI-powered data extraction engines can make a huge difference.

Your main sources of truth will usually be:

- Payment Processors: This is your financial bedrock. Systems like Stripe or LemonSqueezy hold the hard facts—every subscription payment, upgrade, and billing cycle.

- Customer Relationship Management (CRM) Software: Your CRM adds the human context. It knows when a customer signed up, what plan they’re on, and every interaction they’ve had with your team.

- Analytics Platforms: Tools like Google Analytics or Mixpanel show you what customers are doing. They connect the financial data to actual product engagement, helping you understand the "why" behind the numbers.

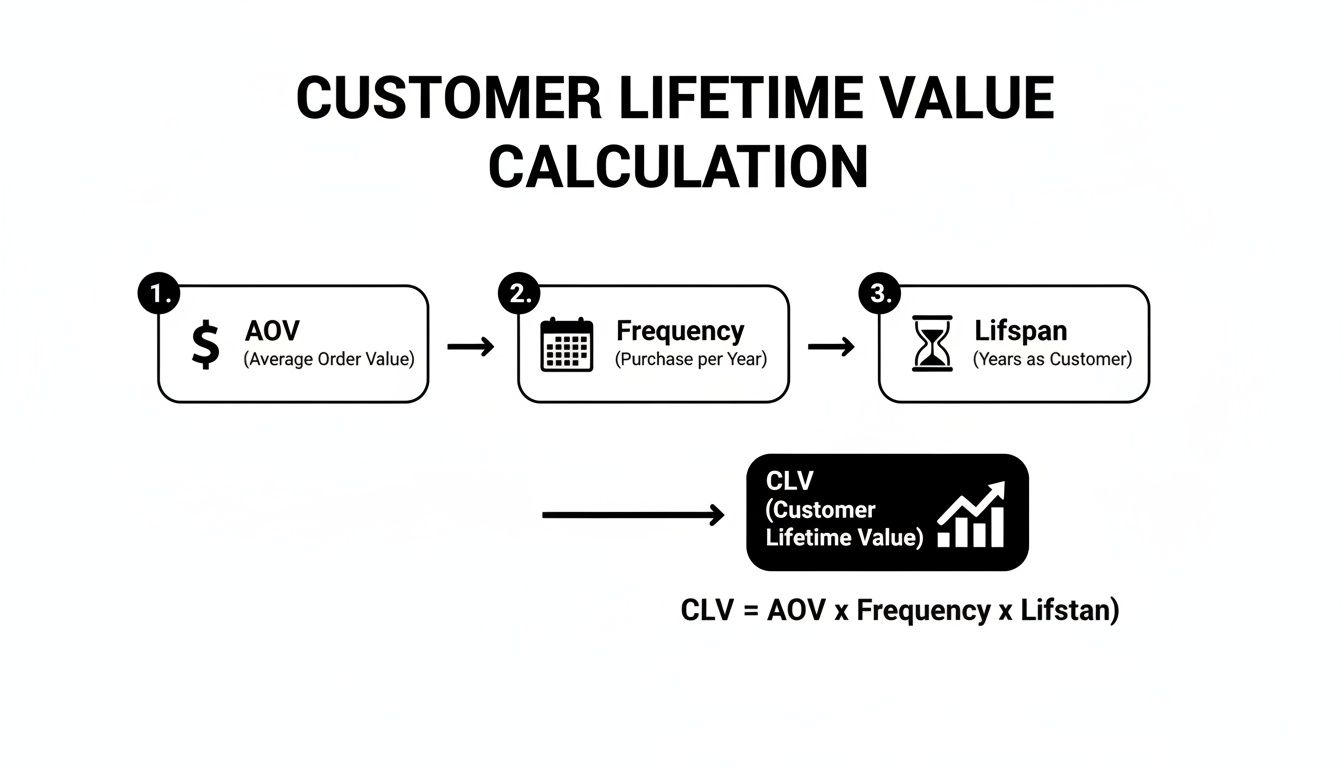

This is how those core metrics—Average Order Value, Purchase Frequency, and Customer Lifespan—fit together to calculate CLV.

As you can see, each piece builds on the last. You're moving from single transactions to a holistic view of what a customer is truly worth to you long-term.

Overcoming Common Data Hygiene Challenges

Just having the data isn't enough. It has to be clean and trustworthy. I’ve seen so many companies get tripped up by messy data, which completely torpedoes their CLV calculations and leads them down the wrong path.

The biggest challenge most companies face isn't a lack of data, but a lack of clean data. Things like mismatched customer IDs, untracked plan changes, and duplicate entries can quietly wreck your analysis, turning a powerful metric into a misleading one.

Here are a few of the most common data traps to look out for:

- Inconsistent Customer IDs: This is a classic. A single user might have one ID in your payment system, another in your CRM, and a third in your analytics tool. This makes it impossible to connect the dots and see their full story. Establishing a single source of truth for customer identity is non-negotiable.

- Untracked Subscription Changes: A customer upgrades, downgrades, or hits pause. If that event isn't meticulously logged, your revenue attribution will be off. You'll end up with a flawed understanding of what drives valuable behavior.

- Handling Refunds and Credits: Looking only at gross revenue will give you a dangerously optimistic picture. You absolutely must subtract all refunds, discounts, and credits to get to the true net revenue. That’s the only way to calculate profitability with any real accuracy.

By getting ahead of these issues, you create a feedback loop you can actually trust. This ensures your customer lifetime value analysis is grounded in reality, giving you the clarity you need to make strategic decisions with confidence.

How Real SaaS Companies Apply CLV Insights

Formulas and data pipelines are great, but they’re only half the story. The real magic happens when you move from spreadsheets to strategy, turning all those numbers into smart business decisions. Top-tier SaaS companies don't just calculate CLV for the sake of it—they weave it into the very fabric of how they operate.

Let’s look at how three different kinds of SaaS businesses use CLV insights to win funding, shape their product, and justify big investments. Think of these as a blueprint for making CLV an active driver of growth, not just another metric on a dashboard.

The Startup Securing Investor Confidence

Picture an early-stage B2B SaaS startup. They've got some good early traction, but they're burning cash fast to get new customers. When they walk into a room with investors to raise a seed round, the conversation always lands on unit economics. A growing user count is nice, but investors want to see a clear road to profitability.

This is where CLV becomes a startup’s secret weapon.

The founders run a predictive CLV analysis on their first batch of customers and discover their average customer is worth $2,500 over their lifetime. This one number changes the entire conversation. Suddenly, they have a solid benchmark for their Customer Acquisition Cost (CAC).

Aiming for a healthy 3:1 CLV-to-CAC ratio, they know they can confidently spend up to $830 to acquire each new customer. They're no longer just throwing money at marketing; they're making a calculated investment with a predictable return. It shows investors their business model is sound, turning a risky bet into a data-backed opportunity.

By presenting a clear CLV analysis, the startup isn't just asking for money; they're presenting a compelling, data-driven case for why their business model works. It shows financial discipline and a deep understanding of their market, which is exactly what investors need to see.

The Product-Led Growth Company Guiding Its Roadmap

Now, think about a product-led growth (PLG) company with a freemium model—maybe a design tool or a project management platform like Asana. They have millions of free users, but the big question is: which features will actually convince people to pull out their credit cards and stick around? With a long list of potential features, every hour of engineering time is gold.

Instead of guessing, the product team segments their users by CLV. They zoom in on their top 10% of customers—the true power users with the highest lifetime value—and dig into how they use the product.

The analysis uncovers a fascinating pattern. These high-CLV customers aren't just using the basic stuff; they're practically living inside an advanced collaboration module that most free users don't even touch. This is a game-changing insight. It gives the product team a clear direction.

They decide to double down on beefing up this collaboration suite, adding slick new integrations and real-time editing. They also redesign their onboarding to gently nudge new users toward this "sticky" feature much earlier. By letting customer lifetime value analysis steer their product strategy, they ensure they’re building what their best customers want, which directly boosts retention and turns more free users into high-value subscribers.

The Membership Platform Justifying Deeper Investment

Finally, let's consider a membership platform for online creators. For them, community engagement is everything. The leadership team wants to make a big investment in a dedicated community manager and a more hands-on support system, but it’s a hefty expense. The CFO is skeptical and wants to see the ROI.

The growth team turns to CLV to build their case. They run a simple cohort analysis, splitting users into two groups:

- Group A: Users who actively post in the community forums and have had at least one good experience with the support team.

- Group B: Users who are completely silent, never engaging with the community or support.

The results were black and white. Group A had a 40% higher customer lifetime value and a much lower churn rate than Group B. The data drew a straight, undeniable line from engagement to long-term value.

This proved that investing in community and support isn't just a cost—it's a direct driver of revenue. Armed with this analysis, the team easily gets the budget for the community manager, framing the expense as a strategic investment in their most valuable asset: their customers.

Boosting CLV with AI and Personalization

Traditional CLV models are great for a snapshot in time. They look at what a customer has done to estimate their future worth. But what if you could know what they are about to do? That's the real game-changer, and it's where AI and machine learning come in.

Think of it as moving from a rearview mirror to a crystal ball. AI analyzes thousands of tiny data points in real time, turning your static customer lifetime value analysis into a dynamic, living forecast. It looks past simple averages to understand the unique story behind each user's clicks, queries, and behavior.

Unlocking Predictive Insights with AI

AI-powered platforms don’t just crunch numbers to calculate CLV—they hunt for patterns that predict what happens next. By sifting through everything from product usage and support tickets to login frequency, these systems build incredibly accurate predictive models.

This fundamentally shifts your strategy from reactive to proactive. You’re no longer just reacting when a customer cancels; you're spotting the warning signs weeks or even months ahead of time and stepping in to help.

These AI models can automatically flag things like:

- Churn Risks: Identifying users whose engagement is dipping or who are behaving like customers who've churned in the past.

- Upsell Opportunities: Spotting your power users who are bumping up against the limits of their current plan—the perfect time to suggest an upgrade.

- High-Value Personas: Finding the common threads and habits of your most profitable customers so you can find more people just like them.

This isn't just a "nice-to-have" anymore. Projections show that by 2025, as much as 95% of all customer interactions will be powered by AI. And it works. Companies deploying AI-driven platforms have seen CLV jump by as much as 25% by creating these hyper-personalized customer journeys.

Driving Growth Through Omnichannel Personalization

Those predictive insights are gold, but they only create value when you act on them. Knowing a customer might churn is one thing; delivering the perfect message at the perfect moment to keep them is another. This is where omnichannel personalization, powered by AI, truly shines.

It’s about tailoring every single touchpoint—in-app messages, emails, support chats—to a customer’s specific behavior and predicted needs. The goal is to make your product experience feel less like a one-size-fits-all tool and more like a personal service built just for them.

AI-powered personalization isn't just dropping a name into an email template. It’s about delivering smart, context-aware in-app messages, recommending features they'll actually use, and offering proactive support that shows you're paying attention.

For example, this could be an in-app prompt offering a quick tutorial for a feature a user seems to be struggling with. Or it could be an email highlighting an advanced tool that perfectly matches a high-value customer's recent activity. Each interaction reinforces your product's value and builds real loyalty.

When you connect predictive analytics with smart, automated personalization, you create a powerful feedback loop. The AI spots an opportunity, your personalization engine delivers the right experience, and the customer's response feeds right back into the model, making it even smarter for the next time. This continuous cycle is the key if you want to know how to increase customer lifetime value in a way that actually lasts.

How Referral Programs and CLV Work Together

When you dig into your customer lifetime value analysis, you’ll probably find that not all your customer acquisition channels are pulling the same weight. It’s a common discovery, and it often points to a powerful truth: customers who come from referrals are almost always your best ones.

Think about it. Paid ads and content marketing cast a wide net, which is great for volume. But referrals bring in people who are already warmed up and ready to listen. This isn't just a minor difference; it’s a fundamental shift that impacts your long-term profitability.

It all boils down to one simple, human factor: trust. A person who clicks an ad is a skeptic. You have to win them over from ground zero. But someone who signs up because their friend recommended you? They walk in the door already believing in what you do. That built-in confidence is a massive head start.

Why Referrals Bring in High-Value Customers

This initial foundation of trust has a ripple effect that touches every part of the CLV equation. Customers from referrals aren't just another lead in the funnel; they're the start of a relationship, and that relationship tends to be stronger and more profitable from the get-go.

Here’s a quick breakdown of why referred customers consistently pack a bigger CLV punch:

- Natural Product-Fit: We recommend products to people we think will actually benefit from them. This simple act of curation means referred users are far less likely to be a bad fit, which cuts down on that early-stage churn.

- Built-in Loyalty: The recommendation from a trusted source creates a "stickier" relationship. These customers tend to feel more connected to your brand and are often more understanding if minor bumps pop up along the way.

- Quicker Engagement: They show up with a clearer idea of your product's value. Because of this, they get the hang of key features faster and are more likely to become true power users.

A great referral program isn't just another way to get new sign-ups. It's a CLV multiplication engine. It’s a system for bringing in customers who are already wired to be more loyal, more engaged, and ultimately, more valuable over time.

Making Referrals Your Growth Engine

A smooth, easy-to-use referral program can create a self-sustaining growth loop. Instead of pouring money into acquiring cold leads month after month, you’re turning your happiest customers into your most powerful marketing team. This is a direct investment in your company’s future, attracting a customer base that's healthier and more profitable right from the start.

Of course, to do this right, you need a reliable way to keep track of it all. That’s where a dedicated referral tracking program becomes essential.

This whole strategy gets even more powerful when you add personalization into the mix. We know that personalized, omnichannel experiences can boost CLV by 30%. In a world where 89% of businesses now say they compete mostly on customer experience, it’s no surprise that companies nailing personalization are bringing in 40% more revenue. You can read more about these customer experience trends and their impact.

By giving your referred customers a personalized journey, you’re reinforcing the trust they arrived with and ensuring you get the absolute most out of their lifetime value.

Your Top CLV Questions, Answered

Alright, we've covered the what, why, and how of CLV. But when the rubber meets the road, you're bound to have a few more practical questions pop up. That's totally normal.

Think of this section as your go-to cheat sheet for those "What do I do now?" moments. Let's tackle some of the most common questions that come up once you start digging into your own CLV analysis.

How Often Should We Calculate CLV?

There's no single magic number here—the right timing really hinges on your business model. The key is to find a cadence that gives you useful insights without creating a ton of extra work.

Here’s a good rule of thumb:

- Fast-Paced SaaS & E-commerce: You'll probably want to run a customer lifetime value analysis monthly or at least quarterly. Things move quickly in these spaces. Regular check-ins help you catch trends early, see how customer behavior is shifting, and tweak your marketing budget before it's too late.

- Enterprise or High-Touch Services: With longer sales cycles and stickier customer relationships, a bi-annual or even annual calculation often does the trick. You're looking for major strategic shifts, not minor monthly blips.

The Bottom Line: The goal isn't just to have a number. It's to use that number to make smarter decisions. Your calculation frequency should line up with your planning cycles, whether that's a monthly marketing huddle or a quarterly business review.

What Is a Good CLV to CAC Ratio?

This is one of the most important health metrics for any growing business. The CLV to Customer Acquisition Cost (CAC) ratio tells you if your growth engine is sustainable or if you're just burning cash.

While it can vary a bit by industry, the gold standard is a 3:1 ratio.

Simply put, for every dollar you spend to bring in a new customer, you should be getting $3 back over their lifetime.

Let's break that down:

- A ratio below 1:1 is a red flag. You're actively losing money with every new sign-up.

- A 1:1 ratio means you're just breaking even on your marketing spend—not a recipe for profit.

- A 3:1 ratio (or higher!) is the sweet spot. It signals a healthy, profitable, and scalable business model.

Keeping a close eye on this number isn't just a vanity metric; it’s fundamental to making sure you're scaling responsibly. It’s the difference between just getting bigger and actually getting stronger.

Ready to turn your best customers into your most effective marketing channel? Refgrow makes it easy to launch a fully native referral program directly inside your SaaS product. Start building a high-CLV customer base today. Learn more about Refgrow.