For any subscription business, Monthly Recurring Revenue (MRR) is the single most important number to watch. It’s the predictable revenue you can confidently expect to bring in every month.

Think of it this way: MRR boils down all your different pricing plans and billing cycles—monthly, quarterly, annual—into one straightforward, normalized figure. It’s not just a metric; it's the financial pulse of your company. It tells you exactly how you're doing right now and helps you map out where you're headed.

Why MRR Is the Foundation of Sustainable Growth

At its heart, understanding what is monthly recurring revenue is about finding clarity in the chaos. One-time sales create unpredictable cash flow, making it tough to plan. MRR, on the other hand, gives you a stable baseline you can rely on. This stability is the bedrock of smart financial planning and strategic thinking, especially for SaaS companies.

Imagine trying to drive a car with a broken speedometer that erratically jumps between 0 and 100 mph. You'd have no idea how fast you were going, how much fuel you needed, or when you’d reach your destination. Running a subscription business without tracking MRR is the same kind of guessing game—it's chaotic and leaves you flying blind.

The Power of a Predictable Metric

The real magic of MRR is how it cuts through the noise. It takes all your different subscription terms and gives you a normalized, apples-to-apples view of your financial health. A customer signing a $1,200 annual plan doesn't create a $1,200 spike this month; it correctly adds $100 to your MRR. This smooths out the revenue bumps and provides a true picture of your company's performance.

With this single metric, you can start making much smarter decisions. It allows you to:

- Forecast Future Revenue: When you know what's coming in, you can confidently budget for new hires, marketing campaigns, or product updates.

- Measure Business Momentum: You can track your growth month-over-month to see if your strategies are paying off or if it's time to adjust course.

- Attract Investor Confidence: For venture capitalists and other stakeholders, a healthy and growing MRR is often the #1 indicator of a scalable, successful business.

By tracking new customers, upgrades, downgrades, and churn, MRR tells the full story of your business's health. It’s not just about the final number; it’s about understanding the "why" behind it. This guide will show you exactly how to master this crucial metric.

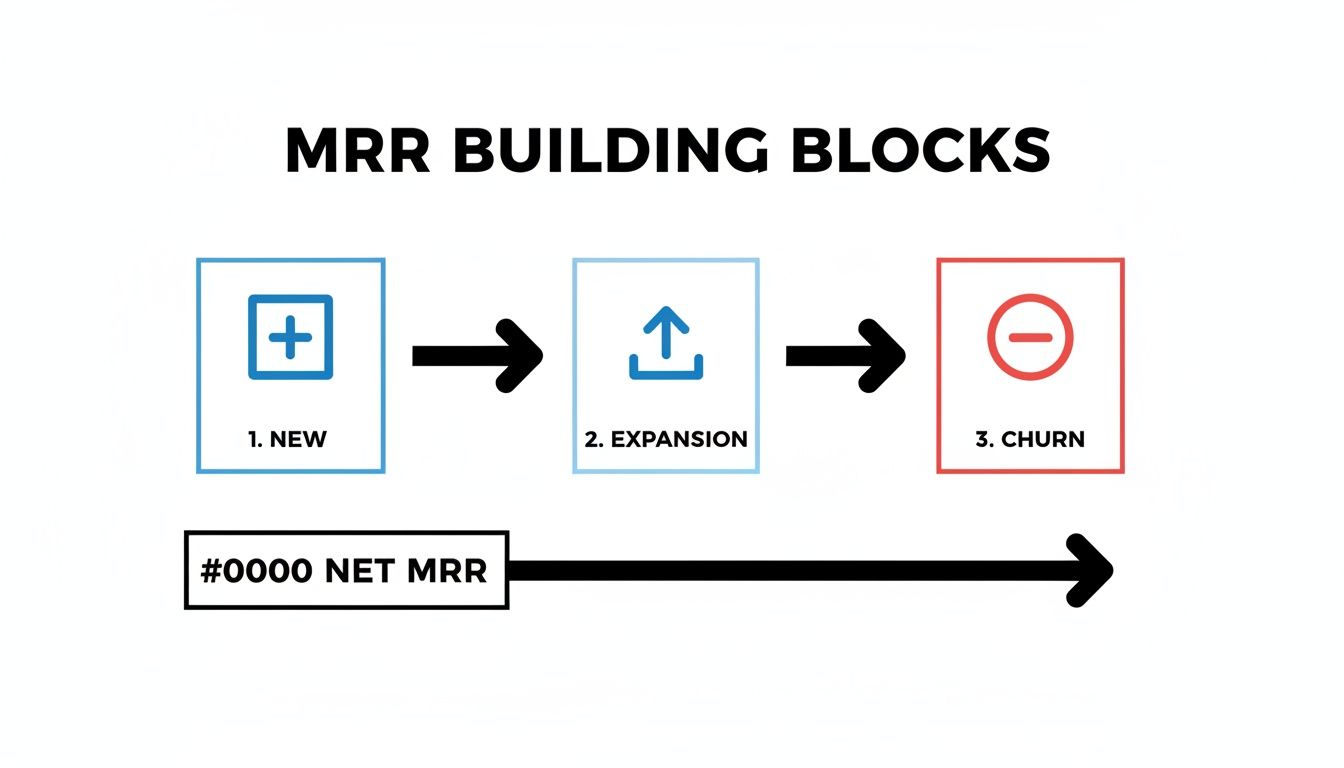

The Building Blocks of Your MRR Story

Your total Monthly Recurring Revenue is just the headline. The real story—the one that tells you where your business is actually heading—is hidden in its component parts. To really get a grip on your company's health, you need to understand the individual movements that add up to that final MRR number.

Think of it this way: breaking down your MRR turns a flat, static number into a dynamic, living tool. It reveals why your revenue is changing, not just that it is. This is the kind of insight you need to make smart, strategic decisions that actually drive growth.

The Four Key MRR Components

Each type of MRR tells a unique part of your growth story. By tracking them separately, you can quickly spot what’s working and what’s breaking.

New MRR: This one’s simple. It’s all the recurring revenue you gained from brand-new customers who signed up this month. If you land ten new customers on a $50/month plan, that's $500 in New MRR.

Expansion MRR: This is where your existing customers show their value. Expansion MRR comes from customers who upgrade to a pricier plan, add more seats, or buy an add-on. For example, when a customer jumps from a $75/month plan to a $150/month plan, you’ve just generated $75 in Expansion MRR.

Contraction MRR: This is the flip side of expansion. It's the revenue you lose when current customers downgrade to a cheaper plan or remove features. If a team cuts its user count and their bill drops from $200 to $150, you’ve just seen $50 in Contraction MRR.

Churned MRR: This is the revenue you lose completely when customers cancel their subscriptions. If five customers on a $30/month plan decide to leave, you’ve lost $150 in Churned MRR.

These four building blocks give you the full picture. A huge New MRR might look great on the surface, but if it's consistently getting erased by high Churned MRR, you don't have a sales problem—you have a retention problem.

Why Expansion MRR Is a Growth Superpower

Bringing in new customers will always be important, but zeroing in on Expansion MRR is often a smarter, more profitable play. Your happiest, most loyal users are your biggest growth lever.

In fact, recent benchmarks show that expansion revenue now accounts for 35% of total new revenue for SaaS companies. This proves that growing your existing accounts can be a far more efficient engine for growth than just chasing new logos. You can see more on this in a report about recurring revenue trends from Aptitude Software.

This focus on your current customer base is directly linked to another vital SaaS metric. To go deeper, check out our guide on how to calculate SaaS customer lifetime value and see how it impacts your long-term success. Once you master these components, you’re no longer just reporting a number; you're actively shaping the story of your company’s growth.

How to Calculate Your Monthly Recurring Revenue

Figuring out your MRR isn't some dark art of finance. It's actually pretty straightforward. At its most basic, the calculation gives you a quick pulse check on the health of your subscription business.

The simplest way to get a baseline number is to multiply the total number of paying customers you have by the average amount each one pays you every month. Think of it as a quick, back-of-the-napkin calculation.

Simple MRR Formula:

Total Active Customers x Average Revenue Per Account = Monthly Recurring Revenue

So, if you have 200 customers each paying an average of $50 a month, your MRR is a solid $10,000. This is a great starting point, but it's just a snapshot. It doesn’t really tell you which way the wind is blowing—are you growing, stalling, or shrinking? For that, we need to dig a little deeper.

The Net New MRR Formula for True Growth Insights

To really understand your company's momentum, you need to calculate your Net New MRR. This is where the real story is. This figure accounts for all the movement within a given month—the good, the bad, and the ugly. It shows you the net result of all your customer activity.

The formula is essentially a balancing act, weighing the revenue you've gained against the revenue you've lost.

Net New MRR Formula:

(New MRR + Expansion MRR) - (Contraction MRR + Churned MRR) = Net New MRR

Looking at MRR this way gives you a much richer understanding of your business's health by breaking growth down into its fundamental pieces.

As you can see, real growth isn't just about getting new customers. It's a constant tug-of-war between bringing in new revenue and keeping the customers you already have from walking out the door.

Putting the Calculation into Practice

To make this crystal clear, let's walk through an example. The table below shows how a fictional company, "Connectly," would calculate its Net New MRR for the month of May.

Sample MRR Calculation for a SaaS Startup

| MRR Component | Description | Amount |

|---|---|---|

| New MRR | 10 new customers signed up for the $100/month plan. | +$1,000 |

| Expansion MRR | 5 existing customers upgraded to a higher-tier plan. | +$300 |

| Contraction MRR | 2 customers downgraded their plans to a lower tier. | -$100 |

| Churned MRR | 3 customers on the $100/month plan cancelled. | -$300 |

With these numbers, we can plug them right into the formula to see how Connectly did in May:

($1,000 New + $300 Expansion) - ($100 Contraction + $300 Churn) = $900 Net New MRR

So, even though they lost some revenue to downgrades and cancellations, Connectly still grew its monthly recurring revenue by a net total of $900. This example also shows why understanding what is churn rate is so vital; it's a direct counterweight to your growth efforts.

Common Calculation Mistakes to Avoid

Getting this right comes down to accuracy. A classic mistake is to lump one-time payments into your MRR. Things like setup fees, training sessions, or one-off consulting projects don't belong here.

They aren't recurring, and including them will inflate your MRR, giving you a dangerously false sense of security. Always keep them separate to maintain a clean, reliable metric you can actually trust.

Why MRR Is Your Most Important SaaS Metric

Forget vanity metrics like sign-ups or website traffic for a second. In the world of SaaS, Monthly Recurring Revenue (MRR) is your true North Star. It cuts through the noise and gives you a clear, honest signal of your company’s health and momentum.

Think of MRR as the foundation you build your entire business on. It's not just about the money that hit your bank account this month; it’s about having a predictable pulse on your cash flow. That predictability is what lets you shift from making reactive guesses to building proactive, confident growth strategies.

The Pillar of Financial Forecasting

Predictability is power. When you know your MRR, you can actually forecast your financial future with a surprising degree of accuracy. This isn't just a nice-to-have—it’s what allows you to budget for real, tangible growth.

Suddenly, you can answer the big questions with data, not just hope:

- Can we afford to bring on that new engineer next quarter?

- Do we have the cash to double down on our marketing campaigns?

- Is now the right time to invest in that new software or infrastructure?

Without a firm grip on your monthly recurring revenue, these are just risky bets. With it, they become calculated steps toward building a sustainable business.

A Barometer for Business Momentum

MRR isn’t just a number on a dashboard; it’s a living indicator of your momentum. Tracking its movement month-over-month tells a story about your company's journey.

Is MRR trending up? Great. That's a clear sign your product is hitting the mark and your growth engine is working. But if it’s flat or, worse, declining, that’s your early warning system flashing. It tells you to dig into your pricing, product, or customer retention before small issues become big problems. This real-time feedback is invaluable for staying sharp.

The Key to Investor Confidence

When you walk into a room with investors, VCs, or even internal stakeholders, a strong, consistently growing MRR speaks volumes. It’s the clearest proof you have a viable business model—one that isn't just surviving on one-time sales.

Strong MRR shows investors you've built a predictable revenue engine, you're keeping customers around, and you have a clear path to profitability. It’s the primary metric they’ll use to figure out your company’s valuation and potential for success.

This laser focus on recurring revenue is what has supercharged the entire subscription economy. In fact, subscription companies have grown an incredible 4.6x faster than the S&P 500, all by building on a foundation of reliable planning. You can dig into more recurring revenue model statistics to see the full picture, but the takeaway is clear: this predictable growth is exactly what makes MRR the most critical metric you can track.

Proven Strategies to Increase Your MRR

Knowing your Monthly Recurring Revenue is the first step, but the real work starts when you decide to grow it. Growing MRR isn't about finding a single silver bullet. It's a focused effort that pulls together three core parts of your business: bringing in new customers, getting more revenue from the ones you already have, and keeping them from walking away.

Think of it like building a sustainable growth engine, not just plugging leaks in a dam. Let's get into some practical tactics you can use to start boosting your MRR systematically.

Boost Expansion MRR with Smart Pricing

Believe it or not, your happiest customers are often your biggest source of new revenue. Focusing on Expansion MRR is far more cost-effective than chasing down a new customer from scratch. The trick is to make it a no-brainer for them to spend more as their own needs grow.

Here are a few proven ways to do just that:

- Tiered Pricing: Structure your plans so each tier offers a clear step up in value. When a customer's business expands, they should naturally see the logic in moving from a "Starter" plan to a "Growth" plan to get more features or higher limits.

- Valuable Add-ons: Offer optional extras that solve specific problems. This could be anything from advanced analytics to priority support, letting customers tailor their subscription without having to jump to a whole new tier.

- Usage-Based Models: Consider a model where customers pay more as they use your product more. This approach ties your revenue directly to the value they get, creating a natural path for growth.

Reduce Churn and Protect Your Revenue Base

Every time a customer cancels, they take a piece of your hard-earned MRR with them. Slashing your churn rate isn't just a good idea—it's a non-negotiable part of any real growth strategy. This means being proactive, not just reacting to cancellations.

You need systems to figure out why customers are leaving and to connect with them before they decide to go.

A low churn rate is the foundation of a healthy MRR. It ensures that the new revenue you bring in contributes to actual growth, rather than just replacing what you've lost.

For instance, you could set up automated emails that trigger when a user's activity drops, offering a helping hand or pointing them to useful resources. It's also incredibly valuable to create insightful exit surveys for cancelling customers. The feedback you get is gold—it shows you exactly where the product gaps or service issues are that you need to fix.

Drive New MRR with Scalable Acquisition Channels

Finally, you need a reliable engine for bringing in New MRR. Sure, paid ads and content marketing are important, but they can get expensive and take time to show results. A powerful, and often overlooked, strategy is to turn your existing customers into your best sales team.

While we often talk about this in a SaaS context, the idea of recurring revenue applies to plenty of other subscription businesses. For example, a gym that offers flexible gym membership plans is using a similar principle to stabilize its income stream.

This is where a native affiliate marketing program can be a complete game-changer. By building a referral program right into your product, you give your happiest users a real incentive to promote your platform in exchange for commissions. This creates a powerful, automated growth loop where your best customers bring you more great customers, directly fueling your MRR. This approach also gives you a clearer picture of your acquisition costs. If you want to dive deeper into that metric, you can learn how to calculate customer acquisition cost in our detailed guide.

Common MRR Mistakes and How to Avoid Them

Getting your MRR calculation right is fundamental for making smart decisions, but it's surprisingly easy to get it wrong. A few common slip-ups can seriously warp your understanding of your company's health.

The biggest mistake I see? Lumping one-time payments into your MRR. Things like setup fees, one-off consulting projects, or implementation charges aren't recurring. They inflate your numbers for one month, giving you a false sense of security. Always keep these separate from your predictable revenue stream.

Another classic error is mishandling long-term contracts. When a customer pays $1,200 for an annual plan, you can't just add $1,200 to this month's MRR. You have to normalize it. That $1,200 actually contributes $100 per month. This simple bit of math keeps your reporting consistent across all your billing cycles.

Finally, some businesses overlook the small details that add up, like forgetting to subtract transaction fees or discounts from the final number. But perhaps the most dangerous mistake of all is obsessing over the top-line MRR figure without digging any deeper.

A high total MRR can easily hide an even higher churn rate. That's why focusing on the components of MRR is so critical for sustainable growth.

If you ignore the moving parts within your MRR—new business, expansion, contraction, and churn—you're flying blind. A high churn rate, for example, can act like a silent leak in your revenue bucket, draining your growth month after month. That's why figuring out how to reduce churn rate is just as important as acquiring new customers.

Frequently Asked Questions About MRR

As you get more comfortable with MRR, a few common questions always seem to come up. Let's walk through them to make sure you have a rock-solid understanding of how to use this metric.

What Is the Difference Between MRR and ARR?

The biggest difference between Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) is simply the lens you're looking through. MRR gives you that close-up, month-to-month picture of your predictable revenue stream. It's fantastic for tactical decisions and tracking your team's performance in the short term.

ARR, on the other hand, is the wide-angle view. You calculate it by multiplying your MRR by 12 (ARR = MRR x 12). This gives you an annualized look at your revenue, which is incredibly useful for long-term financial planning and valuation talks. SaaS businesses that focus on annual contracts often lean more heavily on ARR to understand their high-level trajectory.

How Does MRR Relate to Customer Lifetime Value?

Think of MRR and Customer Lifetime Value (CLV) as two deeply connected parts of your growth story. MRR tells you how much recurring revenue you're generating this month. CLV, however, projects the total revenue you can expect from an average customer throughout their entire time with you.

A healthy, growing MRR is the engine that drives a high CLV. Every time you add a new customer or expand an existing account, you're not just bumping up this month's numbers—you're also increasing the potential value of your entire customer base over the long haul.

It's like this: MRR is your current speed, while CLV is the total distance you can go. You need to know both to understand if you're on the right road.

How Often Should We Track and Report MRR?

Honestly? All the time. MRR isn't a "set it and forget it" metric you glance at every few months. Your core team should be keeping an eye on it at least weekly to catch trends before they become major problems or to double down on what's working.

When it comes to formal reporting for leadership or board meetings, a monthly rhythm is the standard. This gives you enough data to analyze the moving parts—New MRR, Expansion, and Churn—and turn those insights into a smart strategy for the month ahead.

Ready to turn your happiest customers into a powerful growth engine? Refgrow makes it easy to launch a native affiliate marketing program right inside your SaaS product. With just one line of code, you can build a scalable revenue channel that directly boosts your MRR. Start growing with Refgrow today.