Calculating commission percentage is simpler than it sounds. At its core, you just divide the commission amount by the total sale price, then multiply that by 100.

The formula looks like this: (Commission / Total Sales) × 100 = Commission Percentage. It's a straightforward way to see exactly what slice of a sale goes to the person who made it happen.

Understanding Commission Calculation Essentials

While the math itself is easy, the real trick is knowing which numbers to plug in. Getting this right comes down to mastering two key components: the Sales Amount and the Commission Rate. Nailing these is the foundation for any fair and accurate payout, whether you're managing an in-house sales team or a growing affiliate program.

The sales amount, for instance, isn't always the sticker price. Many businesses calculate commissions based on profit margin to keep the company healthy. Likewise, the commission rate might be a simple flat percentage, or it could get more interesting with tiers based on performance or the type of product sold.

Defining Your Core Numbers

Before you even touch a calculator, you need to be crystal clear on what you're measuring. A classic mistake I've seen countless times is assuming "total sales" is the default base for every calculation. It rarely is.

Imagine a SaaS salesperson closes a $10,000 contract. If the company’s policy is to pay commission on the gross margin—let's say that's $6,000—using the wrong base number throws everything off. This is where miscommunications and payout disputes are born.

So, calculating the actual commission payout usually involves multiplying the correct sales base by a predetermined commission rate. For example, if a rep brings in $100,000 in sales and their rate is 5%, the commission is $5,000. It's a common approach because it's so easy to understand. For a deeper dive into different commission structures, Remuner offers some great insights.

Key Takeaway: Always clarify whether your commission base is total revenue, gross margin, or another specific metric. This one small detail prevents the biggest and most common calculation errors.

To make sure we're all on the same page, let's quickly break down the essential terms you'll run into when setting up your commission structure.

Key Commission Terms Explained

| Term | Definition | Example |

|---|---|---|

| Sales Amount | The total value of the sale used as the base for the calculation. | A $1,000 software subscription. |

| Commission Rate | The percentage of the sales amount that is paid out as a commission. | A 10% rate on all new customer contracts. |

| Gross Margin | The profit left over after subtracting the cost of goods sold (COGS) from revenue. | A $1,000 sale with $400 in COGS has a $600 gross margin. |

| Payout | The final dollar amount paid to the salesperson or affiliate. | On a $1,000 sale with a 10% rate, the payout is $100. |

Getting these terms straight is the first step toward building a commission plan that’s both motivating for your partners and sustainable for your business.

Calculating Revenue-Based Commissions

Let's dive into the most popular commission model out there, especially in the SaaS world: revenue-based commissions. This is the bread and butter for many sales teams and affiliate programs because it directly links what someone earns to the revenue they bring in. It's clean, simple, and creates a powerful incentive.

This model's popularity comes from its straightforward nature. Whether you're in software or real estate, the logic is the same. If a sales rep closes $50,000 in new business with a 10% commission rate, they walk away with $5,000. It's a transparent system that perfectly aligns the salesperson's drive with the company's bottom line. For more on this and other commission types, the team at CaptivateIQ has a great explainer.

Handling Simple and Complex Deals

For a straightforward, single-product sale, the math is easy. A $2,000 deal at a 15% commission? That’s a $300 payout. But let's be real, things are rarely that simple. What happens when you have a multi-product deal where each item has a different commission rate?

This is actually a smart strategy many companies use to push new or high-margin products. For instance, you might see a standard 10% commission on the core product but an enticing 20% on a new add-on to get the sales team excited about promoting it. To figure out the total payout on these mixed deals, you just calculate the commission for each product separately and then add them all together.

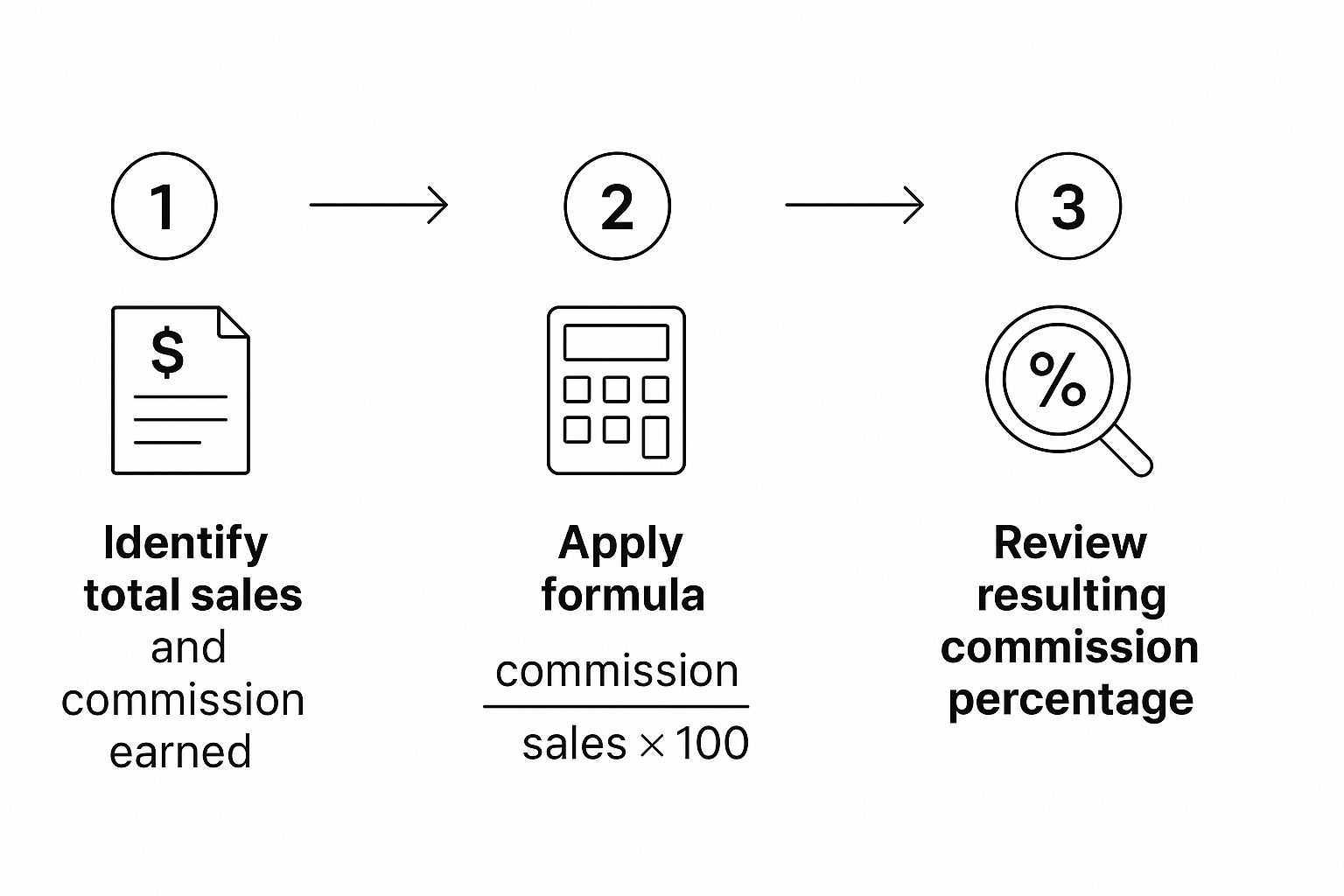

This visual breaks down the simple three-part process for figuring out your commission percentage from a sale.

As you can see, once you have your inputs straight, applying the formula gives you a consistent and accurate rate every time. If you want to get into the nitty-gritty of the math, we've got a whole guide on the commission rate formula that breaks it down even further.

Pro-Tip: Trying to track multi-product sales in a spreadsheet can turn into a real headache. I’ve found the

SUMPRODUCTfunction to be a lifesaver here. Just set up one column for sales amounts and another for the matching commission rates.SUMPRODUCTdoes the heavy lifting by multiplying each pair and adding them up in a single go. It saves a ton of time and cuts down on manual errors.

Exploring Different Commission Structures

When you start digging into commission, you quickly realize it's not just about giving someone a cut of the revenue. The way you structure your payouts is a powerful tool. It can motivate specific behaviors, protect your bottom line, and reward the kind of performance that truly pushes your business forward.

Choosing the right model is all about aligning your team's incentives with your company's goals. Some businesses keep it simple with a flat fee, like $7 per item sold, which makes the math easy but might not incentivize bigger deals. Others get more sophisticated, basing commissions on profitability—the total revenue left after accounting for business expenses. If you want to dive deeper into the various payment structures out there, you can discover more insights on commission models at Study.com.

Tiered Commissions That Reward Growth

A tiered commission structure is fantastic for lighting a fire under your top performers. Instead of a single flat rate, the commission percentage actually increases as a salesperson smashes through different sales targets. This creates a compelling reason to not just meet quota, but to completely blow past it.

Here’s what that might look like for a SaaS company:

- 10% commission on the first $25,000 in monthly recurring revenue (MRR).

- 15% on any MRR they bring in between $25,001 and $50,000.

- A very attractive 20% on all MRR generated above $50,000.

This setup keeps the entire team hungry. Once they hit their initial goal, there's always a more lucrative tier just ahead, pushing them to finish every single sales period on a high note. To figure out the total payout, you just calculate the commission earned at each tier and add them all together.

Gross Margin Commissions for Profitability

Let's be honest: a huge sale isn't always a profitable one, especially if your rep had to give away a massive discount to close it. This is where a gross margin commission model really proves its worth. It ties your sales team's paycheck directly to the profitability of a deal, not just the top-line revenue number.

Calculation Formula: Gross Margin = Total Sale Price – Cost of Goods Sold (COGS) Commission = Gross Margin × Commission Rate

This approach fundamentally changes how a salesperson thinks. They start acting more like business owners, protecting your margins and thinking twice before offering a steep discount. It ensures that every deal they bring in is a genuinely healthy one for the company.

Building Your Commission Strategy for SaaS

When you're dealing with recurring revenue, calculating commissions isn't just a math problem—it's a core piece of your growth strategy. For SaaS companies, it’s not about rewarding a single sale; it's about paying for the long-term value that a new customer brings. The whole mindset shifts from one-time transactions to sustained partnerships.For your internal sales team, the big question is usually Monthly Recurring Revenue (MRR) versus Annual Contract Value (ACV). Paying commissions on ACV gives your reps a big, motivating check right away, especially when they land those larger annual deals. On the flip side, an MRR-based commission creates a steady income stream for them that actually mirrors the way your company gets paid.

Handling Upgrades and Customer Churn

So, what happens when a customer upgrades? It's a common scenario, and the best way to handle it is to pay a commission only on the net new revenue. If someone jumps from a $50/month plan to a $150/month plan, the commissionable amount is the $100 increase. This approach keeps things fair and directly rewards the upselling effort.

Of course, you also need to protect your business from early churn. This is where a clawback policy comes in. If a new customer signs up and then cancels within the first month or two, you need a way to reclaim the commission. A typical clawback window is 30-90 days, which ensures you're only paying out for customers who stick around.

A great commission structure is about more than just the percentage. It’s a partnership built on trust. Things like transparent tracking, a fair cookie window, and paying on time are what build strong, profitable relationships with your affiliates.

Best Practices for Your Affiliate Program

Running an affiliate program is a slightly different ballgame. To attract the best partners, you need an offer that's both competitive and fair. A good commission rate is just the starting point.

Here are a few things that truly make an affiliate program stand out:

- A Generous Cookie Duration: This is how long you'll credit an affiliate for a sale after someone clicks their link. A 30-90 day window is standard practice and shows partners you respect the work they put into warming up a lead.

- Transparent Tracking: Trust is everything. Your affiliates absolutely need a dashboard where they can see their clicks, conversions, and earnings in real time. It's not optional.

- Recurring Payouts: If you sell a subscription, offering a recurring commission is one of the most powerful ways to attract top-tier partners. A common model is offering 20% of all payments for the first year. This gets them invested in finding you high-quality, long-term customers.

Focusing on these details will help you build a program that doesn't just work on paper but actually drives real, sustainable growth. For more hands-on tips, take a look at our guide on how to increase affiliate sales.

Putting Commission Calculations Into Practice

Knowing the theory behind commission formulas is great, but let's be real—manually tracking every sale, tier, and payout in a spreadsheet is a recipe for disaster. That’s where the errors creep in and the hours start to vanish. This is precisely why automation platforms exist: to connect the dots between your commission strategy and flawless execution.

A tool like Refgrow lets you ditch the manual grunt work and set up even the most complex commission structures with a few simple clicks. Forget wrestling with VLOOKUPs and pivot tables. You can easily configure tiered rates, assign different commissions for specific products, or automate recurring payouts for subscription sales, all from one dashboard.

Automating Your Commission Workflow

The biggest win here is getting rid of manual data entry for good. When your affiliate platform integrates directly with your payment processor, it automatically logs sales, applies the right commission rules you’ve established, and calculates the exact payout owed to each partner. This doesn't just save a ton of time; it dramatically cuts down on the risk of human error—the kind of costly mistakes that can seriously damage relationships with your sales team or affiliates.

Here’s a glimpse of what it looks like to set up different commission types within an affiliate management tool.

An interface like this makes it simple to define rules for one-time, recurring, or lifetime commissions, guaranteeing every single sale is tracked and paid out correctly.

When you automate commission tracking, you’re not just saving time—you’re freeing up your team to focus on high-impact strategy instead of tedious administration. It means you can spend more energy recruiting top-tier partners and actually growing the program.

Of course, commissions are just one piece of the puzzle. It’s also vital to keep an eye on other key business metrics. For instance, a solid grasp of your customer acquisition cost calculation gives you a much clearer view of your overall profitability.

Once you have a robust system in place, you're ready to scale. For a deeper dive into growing your program, our guide on how to effectively manage an affiliate program lays out the practical next steps.

Common Commission Questions Answered

Even once you’ve got the formulas down, real-world sales scenarios can throw a wrench in the works. I’ve seen countless questions pop up around everything from industry standards to one-off sales situations and the fine print buried in compensation plans.

Let's clear the air on some of the most common questions I hear from sales pros and program managers when it's time to calculate commission percentages. Getting this right is about more than just math—it's about building trust and making sure everyone feels their hard work is valued.

What Is a Typical Commission Percentage for SaaS Sales?

Things can definitely vary, but a pretty standard range for new business in the SaaS world is 8% to 12% of the Annual Contract Value (ACV). That percentage can definitely creep higher, especially in a competitive space or for top performers who are consistently crushing their goals.

Many companies also incentivize customer loyalty by offering a smaller commission on renewals and upsells. This is usually in the 2% to 5% range and encourages reps to focus on long-term relationships, not just the initial close.

How Do I Calculate Commission on a Discounted Sale?

This is a big one. While you should always check your company’s official policy, the universal standard is to calculate commission based on the net sales amount. That’s the final price the customer actually pays after the discount.

So, if your product has a list price of $1,000 and you give the customer a 10% discount, the final sale is $900. Your commission is based on that $900 number, not the original $1,000.

Key Takeaway: A commission is part of your core pay, tied directly to your sales performance as a percentage of revenue. A bonus is an extra, often one-off reward for hitting bigger targets, like a team goal or a company-wide milestone.

What Is the Difference Between a Commission and a Bonus?

It's easy to get these two mixed up, but they serve very different purposes. A commission is a set percentage of a sale that forms a predictable, recurring part of a salesperson's income. It’s tied directly to your individual performance, deal by deal.

A bonus, on the other hand, is usually a one-time payout for hitting a specific, often much broader, goal. Think of things like smashing a quarterly team target, helping the company hit an annual revenue milestone, or landing a huge strategic client. It's an extra reward, not a core component of your pay structure.

Ready to stop wrestling with spreadsheets and automate your commission tracking? With Refgrow, you can set up any commission structure in minutes and ensure every partner is paid accurately and on time. Get started with Refgrow today.