Uncovering the Revenue Hidden in Plain Sight

It’s an uncomfortable but common truth: you might be sitting on a goldmine of untapped revenue without even knowing it. Many companies think they know their most valuable customers, but I've seen countless leaders have a "lightbulb moment" when they realize their assumptions don't match reality. Businesses often assume their highest-spending clients are their best, but this view can be dangerously shortsighted when you want to improve customer lifetime value.

This misconception comes from chasing short-term wins over long-term profitability. I once saw a retail company discover that its smallest-spending, most frequent buyers were actually more profitable over time than the occasional big spenders. Why? They required less marketing spend, referred more new business, and almost never churned. They were the dependable, low-maintenance revenue stream hiding right there in the data. This really drives home the need to look beyond single transactions and see the long-term potential in your customer base.

Historical vs. Predictive Customer Lifetime Value

To truly get a grip on where your money is coming from, you need to understand the two main ways of looking at customer lifetime value (CLV): historical and predictive. Neither is "better" than the other; they just answer different questions and help with different strategies.

- Historical CLV is like looking in your car's rearview mirror. It calculates the total profit a customer has already generated based on all their past purchases. It’s solid, based on actual numbers, and fantastic for identifying who has been your most valuable customer up to this point.

- Predictive CLV, on the other hand, is like using a GPS for the road ahead. It uses historical data, behavioral patterns, and forecasting models to estimate how much a customer is likely to spend over their entire relationship with you. This is where you can start making proactive decisions to nurture high-potential accounts before they've even hit their peak.

To make this clearer, let's break down the core differences between these two approaches. The table below compares how each method works and where it shines.

| CLV Type | Calculation Method | Time Focus | Best Use Case | Accuracy Level |

|---|---|---|---|---|

| Historical CLV | Sum of all past gross profits from a customer's transactions. | Retrospective (Past) | Identifying past top-performing customer segments and rewarding loyalty. | High (based on actual, known data). |

| Predictive CLV | Uses algorithms and behavioral data (e.g., purchase frequency, engagement) to forecast future value. | Prospective (Future) | Proactive marketing, personalizing user journeys, and allocating resources to high-potential customers. | Varies (depends on data quality and model sophistication). |

As you can see, historical CLV tells you what happened, while predictive CLV helps you shape what will happen next. Both are critical for a complete picture of customer value.

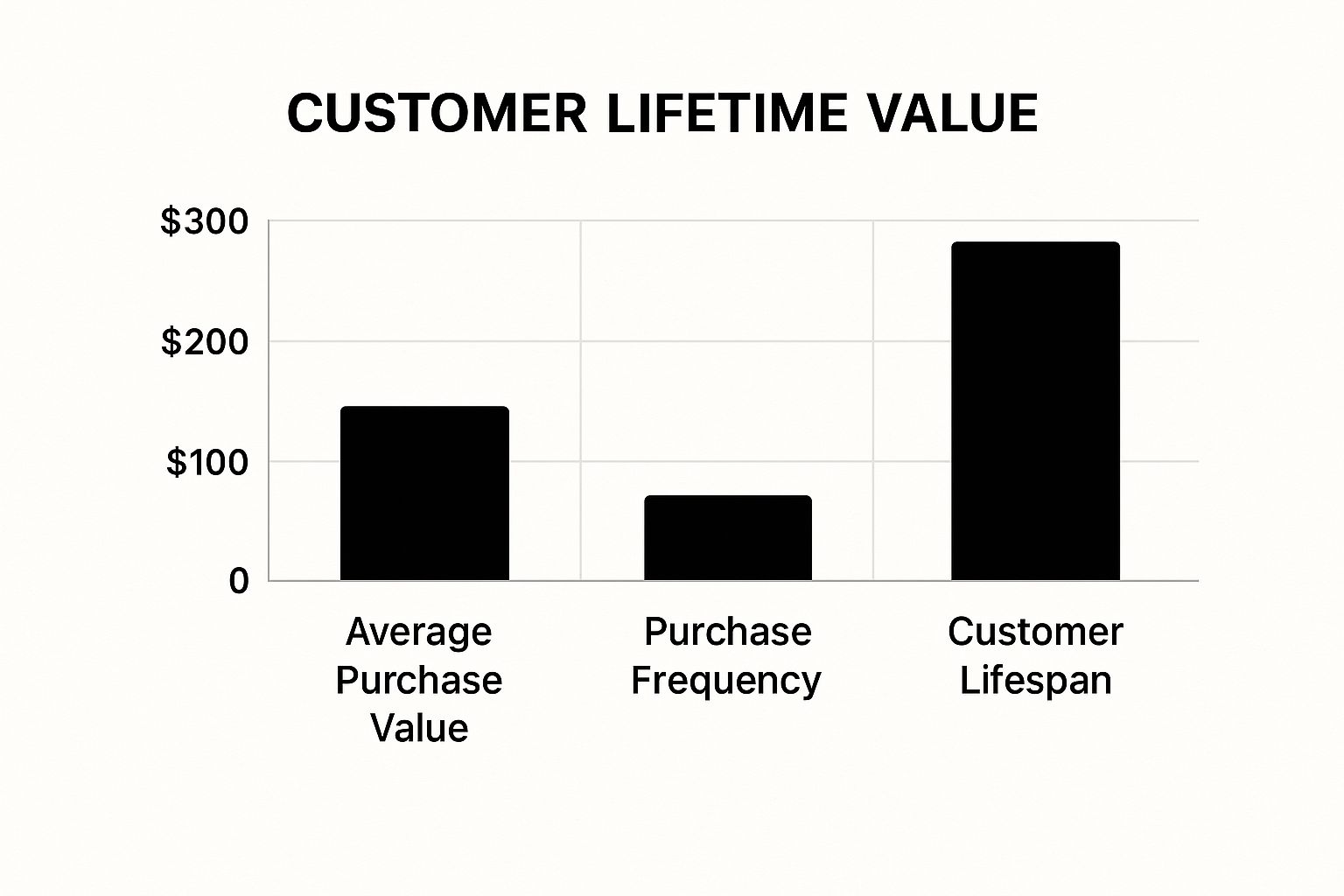

This infographic breaks down the key metrics that influence both historical and predictive CLV calculations.

The visualization shows that a healthy balance of purchase value, frequency, and customer lifespan is the secret to maximizing overall CLV. Yet, despite its importance, many businesses are falling behind. Research shows that by 2025, only 42% of companies will be able to accurately measure CLV, even though 89% agree it's vital for building brand loyalty.

This measurement gap is a huge problem, especially since customer acquisition costs have shot up by 222% in recent years. If you want to learn more, you can explore these customer lifetime value statistics to see why retention and CLV optimization are more important than ever.

Getting Your Numbers Right Without the Math Headaches

Let's roll up our sleeves and talk about the numbers that actually drive your business decisions. Forget the textbook formulas for a second; we’re going to focus on real-world situations you can actually use. Thinking about improving customer lifetime value really begins with knowing what a customer is truly worth over their entire relationship with you, not just a single sale. It’s less about complex algebra and more about understanding customer behavior.

A Simple Way to Calculate CLV

At its heart, figuring out customer lifetime value can be surprisingly simple. Picture this: a new customer signs up for your SaaS tool at $50 a month. If you look at your data and see that, on average, customers stick around for 18 months, your basic historical CLV is $50 x 18 = $900. This straightforward calculation gives you a solid baseline. It’s a quick way to spot your most valuable customer groups without needing a data analyst on speed dial. You can use this number to check if your customer acquisition cost (CAC) is sustainable.

But that's just the starting block. This historical view doesn't capture what could happen, like a customer upgrading their plan or bringing in referrals. To get a fuller picture, many businesses turn to predictive models. For instance, if a customer consistently spends $50 per transaction and makes 20 purchases in their first year, their historical CLV is $1,000. But if predictive analytics suggest they'll keep this up for five years, their potential future CLV jumps to $5,000. For a deeper dive into this, you can check out these insights on CLV's historical and predictive views.

Common Missteps to Sidestep

I've seen many businesses stumble here, either by making their calculations way too complicated or by using incomplete data. A classic mistake is ignoring customer segments. A power user on your enterprise plan will have a completely different CLV profile than a small business on a basic tier. If you lump them together, you’ll get a mushy, misleading average that won't help you make smart decisions for either group.

Another pitfall is forgetting to include the cost of serving the customer. Every support ticket, onboarding session, and check-in call with a success manager adds up. A customer who brings in a lot of revenue but needs constant, expensive support might actually be less profitable than a lower-revenue, self-sufficient one. True CLV is about profit, not just revenue. Before getting lost in complex spreadsheets, it's critical to have a solid grasp of the metric itself. This comprehensive guide on Customer Lifetime Value is a great resource. By starting simple and steering clear of these common errors, you can calculate a CLV that genuinely fuels your growth strategy.

Keeping Customers Around (And Happy to Stay)

Once you’ve got a handle on your customer lifetime value metrics, the real fun begins: keeping those valuable customers engaged for the long haul. This is where so many SaaS businesses drop the ball. They pour their budget into acquiring new customers but often forget about the ones they already have. That’s a massive oversight, especially when research shows a mere 5% increase in customer retention can boost profits by a staggering 25% to 95%.

Thinking about improving customer lifetime value is really about nurturing the relationships you've already built. It’s a mental shift from seeing a one-time sale to fostering a long-term partnership. After all, a loyal customer who feels valued is not only less likely to churn but is also more open to trying new features and becoming a vocal advocate for your brand.

The numbers don't lie. Even small improvements in keeping customers around can have a dramatic effect on your bottom line. We've put together a table to show just how these changes can translate into real profit increases.

Customer Retention Impact on Profitability

Statistical breakdown showing how different retention rate improvements translate to profit increases across various business models.

| Retention Increase | Profit Impact Range | Industry Examples | Implementation Difficulty | ROI Timeline |

|---|---|---|---|---|

| 1% | 5% - 15% | High-volume B2C SaaS, Streaming Services | Low | 6 - 12 months |

| 3% | 15% - 45% | Project Management Tools, Marketing Automation | Medium | 4 - 9 months |

| 5% | 25% - 95% | Enterprise-level CRM, Financial Software | High | 3 - 6 months |

| 10% | 50% - 120% | Niche B2B Platforms, Specialized Analytics Tools | High | 3 - 6 months |

This data clearly shows that the effort you put into retention pays off, often faster and more significantly than you might expect. The higher the retention bump, the more dramatic the profit increase, especially for specialized SaaS products.

Spotting At-Risk Customers Before They Disappear

One of the best retention plays you can make is proactive intervention. Don’t wait for a cancellation email to find out something’s wrong—by then, you're already playing defense. Instead, you need to learn to spot the early warning signs that a customer is drifting away. These red flags are your golden opportunity to step in and turn things around.

Here are a few signals I always keep an eye on:

- A Consistent Drop in Usage: If a daily user suddenly becomes a weekly or monthly one, that's a huge indicator. It means the value they see in your product is fading.

- An Uptick in Support Tickets: A sudden spike in complaints or help requests can signal growing frustration. While it might seem negative, it's actually an engagement point. If you can swoop in and solve their issues, you can transform a bad experience into a memorable, positive one.

- Significant Business Changes: Did your client just go through a merger? Or maybe the person who championed your tool just left the company? These shifts can put your subscription on the chopping block.

When you notice these signs, don't hesitate. A simple check-in call or a personalized email can uncover problems you can fix right away, stopping churn in its tracks. To truly get this right, you'll need a solid game plan based on effective customer retention strategies.

From Satisfied to Advocate

Retaining customers isn't just about preventing cancellations; it's about creating an experience that makes them want to stick with you. This is where you graduate from basic loyalty programs to building genuine advocacy. The key is to provide exceptional, personalized support and constantly ask for their feedback. When customers feel like you're listening—and better yet, when they see their suggestions come to life—they become part of your story.

These are the customers who will be with you for years, who will happily tell their friends about you, and who will ultimately send your CLV through the roof. For more ideas on this, our guide offers additional practical tips to improve client retention and forge those lasting relationships.

Making Every Customer Feel Like Your Only Customer

Generic experiences are the silent killer of your bottom line. Your customers now expect you to anticipate their needs, and if you can't deliver a personalized experience, you're putting a major dent in your ability to improve customer lifetime value. This is about more than just plugging a first name into an email; it's about making each customer feel seen and understood on an individual level. The good news? You don't need a massive AI budget—just a commitment to using the data you already have to be more helpful.

Real personalization feels like helpful guidance, not creepy surveillance. It’s about using behavioral data to create interactions that click. For instance, a SaaS company I know keeps an eye on which features their highest-value customers use most. Instead of a generic monthly newsletter, they send targeted tips and case studies focused squarely on those features. This simple switch reinforces the product's value and shows the customer that the company is truly invested in their success.

Practical Personalization Strategies

You can start adding meaningful personalization to your customer interactions without getting bogged down in technical details. The idea is to shift from mass communication to relevant, timely conversations that build a stronger connection. To really cultivate these strong relationships and boost long-term value, it's worth learning how to design memorable customer journeys that truly resonate.

Here are a few actionable ideas to get you started:

- Segmented Email Onboarding: Ditch the one-size-fits-all welcome series. Create different email tracks based on a user's role or the goal they stated during sign-up. A developer should get a different first email than a marketer.

- Behavior-Triggered Communication: Set up automated check-in emails. Maybe one goes out if a user hasn't logged in for 14 days, or you could offer an advanced tutorial video after they've used a specific feature for the third time.

- Lifecycle-Based Offers: Your upsell and cross-sell messages should match where the customer is in their journey. A brand-new user needs education and support, whereas a power user might be the perfect candidate for an enterprise-level feature.

Avoiding Common Personalization Pitfalls

The biggest mistake I see companies make is either overcomplicating things or using their data incorrectly. Personalization backfires when it's based on bad assumptions or just feels invasive. A classic blunder is sending a promotion for a product a customer just purchased or blasting irrelevant "we miss you" emails to someone who actually uses your product every day.

Start small, test your assumptions, and always focus on being helpful. This approach ensures your personalization efforts build trust and loyalty, which directly contributes to a higher customer lifetime value.

Learning From Companies That Crushed Their CLV Game

Theory is one thing, but seeing how the heavy hitters put customer lifetime value principles into practice gives us a real-world blueprint. Businesses that truly dominate their markets don't just stumble into high CLV; they build their entire strategy around it.

This focus isn't just for consumer brands. In B2B markets, it's estimated that a staggering 76% of annual revenue comes from existing customers, not new ones. This really highlights how critical long-term relationships are for sustainable growth. If you want to see more examples, you can explore how top companies drive success with CLV.

What We Can Learn From the Best

So, what’s their secret sauce? These companies excel in a few key areas that combine to create an experience customers don’t want to leave.

- Amazon’s Personalization Engine: Amazon is the undisputed champion of using data to encourage repeat purchases. Its recommendation engine isn't just a feature; it's the core of the shopping experience. It looks at your purchase history, what you've browsed, and even what other people with similar tastes bought. The lesson here is to make every interaction relevant. When you show customers things they actually want, you remove friction and make buying feel natural.

- Sephora’s Community-Driven Loyalty: Sephora’s Beauty Insider program is so much more than a points card. It fosters a genuine community. Members get early access to products, invites to exclusive events, and a tiered system that makes them feel like VIPs. This shows the power of making loyalty feel like a status symbol, not just a series of transactions.

- Netflix's Retention Focus: The entire Netflix business model is built on retention. Their main job is to keep you subscribed, month after month. They achieve this by constantly adding fresh content and using smart algorithms to suggest your next binge-watch. The key takeaway is to always provide new value. Give your customers a compelling reason to come back and engage with your product regularly.

Turning Inspiration into Action

While these giants have massive resources, the underlying principles can be applied by any business. Take Starbucks, for example. It turned a simple coffee run into a daily habit with its mobile app, which cleverly combines payments, rewards, and personalized offers in one place.

You can do something similar by building a referral program directly into your SaaS application. This approach doesn't just reward loyalty; it turns your happiest customers into a powerful marketing force. For more ideas on how to set this up, you can review these referral program best practices. The goal is to weave retention and advocacy right into the fabric of your product.

Unlocking Additional Revenue From Existing Customers

While keeping customers happy is the foundation for a healthy business, you might be overlooking a significant source of growth: your existing user base. Smart upselling and cross-selling aren't about aggressive sales tactics; they're about anticipating your customers' needs and offering a solution at the perfect moment. In fact, sales leaders report these activities drive about 31% of their revenue, which shows just how powerful this approach can be when handled correctly.

The secret sauce is a mix of timing and relevance. Think about it: a customer who is constantly maxing out their usage of a particular feature is practically asking for an upgrade. Similarly, a team that has just nailed your core product might be ready for a complementary tool that solves their next big challenge.

Mastering the Art of the Offer

Growing revenue from current customers means you need to get inside their heads and understand their journey with your product. Forget about one-size-fits-all promotions and focus on crafting deals that feel like a natural next step for them.

- Develop Natural Upsell Sequences: Don't bombard new users with upgrade pop-ups on their first day. Instead, identify key moments in their lifecycle. For instance, when a user hits a usage cap or becomes a power user of a specific feature, that's your cue. Presenting the next tier as a logical solution to their growing needs feels helpful, not pushy.

- Create Value-Added Cross-Sells: The most effective cross-sells feel less like a pitch and more like a friendly tip. If a customer is getting great results from your project management tool, suggesting an integration with a time-tracking app is a no-brainer. This move not only adds genuine value but also makes your product ecosystem stickier, as we explore in our guide to SaaS customer retention strategies.

- Identify Receptive Customers: Keep an eye on your most engaged users. These are the people opening your emails, sending you feedback, and logging in daily. They are your biggest fans and are the most likely to appreciate an offer for more functionality. A personal outreach to these champions often brings the best results.

By changing your perspective from "selling more" to "helping more," you can find major growth opportunities. This approach not only boosts your customer lifetime value but also validates their decision to partner with you, turning happy clients into loyal advocates who are eager to invest more.

Your Customer Lifetime Value Action Plan

Knowing the theory is one thing, but putting it into practice is where you'll see real gains in customer lifetime value. It's time to build a solid roadmap that focuses on high-impact strategies for your business. This isn't about trying to do a hundred things at once. Instead, it's about making smart, targeted choices that bring in measurable results and create positive momentum.

Start by Measuring and Segmenting

You can't improve what you don't measure. Before you do anything else, you need a clear baseline. The first step is to calculate your current historical CLV to see how you've performed in the past. With that number in hand, the next critical move is to segment your customers. Group them by their value, how they use your product, or the specific problems they're solving with it. This process often reveals who your most profitable customers really are.

You might be surprised to find that your highest-value segment isn't the one with the biggest initial contracts. Often, it's the group with the best retention and the highest expansion revenue. Pinpointing these top-tier customers is fundamental because it shapes every other part of your strategy.

Build Your Retention and Growth Plan

Once you’ve identified your high-value segments, you can create a plan just for them. This goes beyond simply trying to prevent churn; it’s about actively building loyalty and creating opportunities for growth. Here’s a quick checklist to get you started:

- Map the High-Value Journey: Look at the path your best customers took. Which features did they adopt first? At what point did they upgrade? Use these insights to guide newer customers along the same successful route.

- Establish Proactive Check-ins: Don't wait for a customer to run into trouble. Set up automated triggers for outreach, like a dip in their usage or when they hit a key milestone. A simple, personal check-in can make a world of difference.

- Identify Upsell/Cross-sell Moments: Find the natural points in the customer journey where an upgrade or an additional feature would be a perfect fit. Frame these offers as helpful solutions to their evolving challenges.

- Launch a Native Referral Program: Your happiest customers are your most powerful marketers. By embedding a referral program directly into your product, you make it incredibly easy for them to spread the word.

Turning your product into a growth engine doesn't need to be a huge, complicated project. With a tool like Refgrow, you can launch a fully native affiliate and referral program in minutes. Stop sending your customers to clunky, third-party portals and start building a smooth advocacy experience right inside your SaaS. Learn how Refgrow can accelerate your growth today.