For any SaaS startup trying to make its mark, managing cash flow is more than just good accounting—it's the lifeblood of your business. To get a real grip on your operating costs, you have to go deeper than generic advice and build a culture of continuous financial discipline. It's a delicate balance, really, between smart savings now and investing in your long-term growth.

Your Playbook for Sustainable Cost Management

Building a financially tough SaaS business means you have to be proactive about your spending, not reactive. You can't just react when the bank account looks low. The real goal is to weave cost-efficiency right into your company's DNA, making it a constant competitive edge rather than a one-off project you tackle in a crisis. It all comes down to making smart, data-backed decisions that eliminate waste without killing the innovation that got you here.

This whole process kicks off with an honest look at where every dollar is going. I've seen it time and again—founders are often shocked when they look past the high-level P&L statement and see the details.

Laying the Groundwork: Core Cost Reduction Pillars

Before diving into specific tactics, it's helpful to understand the foundational strategies that will guide our approach. Think of these as the core pillars holding up your entire cost management plan. They provide a framework for thinking about every dollar you spend.

| Pillar | Primary Goal | Key Tactic |

|---|---|---|

| Operational Efficiency | Reduce wasted resources and time. | Automating repetitive tasks and workflows. |

| Growth Optimization | Lower the cost to acquire new customers. | Implementing referral-based marketing. |

| Tool & Spend Audit | Eliminate unnecessary software expenses. | Regularly reviewing and rightsizing licenses. |

| Data-Driven Decisions | Ensure spending aligns with ROI. | Tracking key metrics and cost savings. |

Getting these pillars right sets the stage for everything else. They ensure your efforts are comprehensive and sustainable, not just a series of disconnected, short-term fixes.

Setting Clear Reduction Targets

You can't make meaningful cuts without first knowing your starting point. Digging into your key operational metrics is the only way to set realistic targets. This isn't about slashing budgets blindly; it's about making precise, strategic trims where it counts.

I always tell founders to start by analyzing these three areas:

- Customer Acquisition Cost (CAC): What’s the real cost to bring a new customer on board?

- Cloud Infrastructure Spend: Are your server costs growing efficiently as your user base expands, or are they running wild?

- Software and Tool Subscriptions: Are you paying for "shelfware"—licenses nobody uses or tools that do the same thing?

For example, a quick audit might show that 30% of your software licenses are tied to inactive users. That’s pure, low-hanging fruit for instant savings. For more complex tools, you might even need a specialized approach like a Jira license cost optimization framework to really dial in your spending.

A disciplined approach to cost management isn't about preventing spending; it's about ensuring every dollar spent contributes directly to value creation and strategic growth.

A Mindset of Continuous Improvement

Especially when economic winds shift, adopting a cost-conscious mindset across the entire team is what separates the companies that thrive from those that just survive. It’s a global trend. Businesses everywhere are trying to figure out how to manage costs better for the long haul.

With global economic growth projected at a modest 2.6% for 2025, the pressure is on. A recent executive survey showed that 60% expect serious business challenges ahead that will require disciplined spending. This isn’t just a phase; it's the new reality.

This guide is designed to give you that actionable framework. By starting with these foundational pillars, you’ll be ready for the advanced strategies we'll cover later, setting you up with a solid plan for long-term financial health.

Uncovering Your Hidden Cost Drivers

If you want to get serious about cutting costs, you first have to know exactly where your money is going. And I mean exactly. A quick glance at your P&L statement won't cut it. The real opportunities for savings are almost always buried deep in the details of your day-to-day operations. This isn't just about finding the big, obvious expenses; it's about digging into the weeds to find the silent budget killers.

I’ve seen this time and again with founders I work with. They're often shocked by what a deep dive uncovers. The culprits are rarely the big, flashy expenses. Instead, they’re the small, recurring charges that quietly add up—the digital equivalent of a leaky faucet. Think unnoticed cloud service overages or forgotten software seats for team members who left months ago.

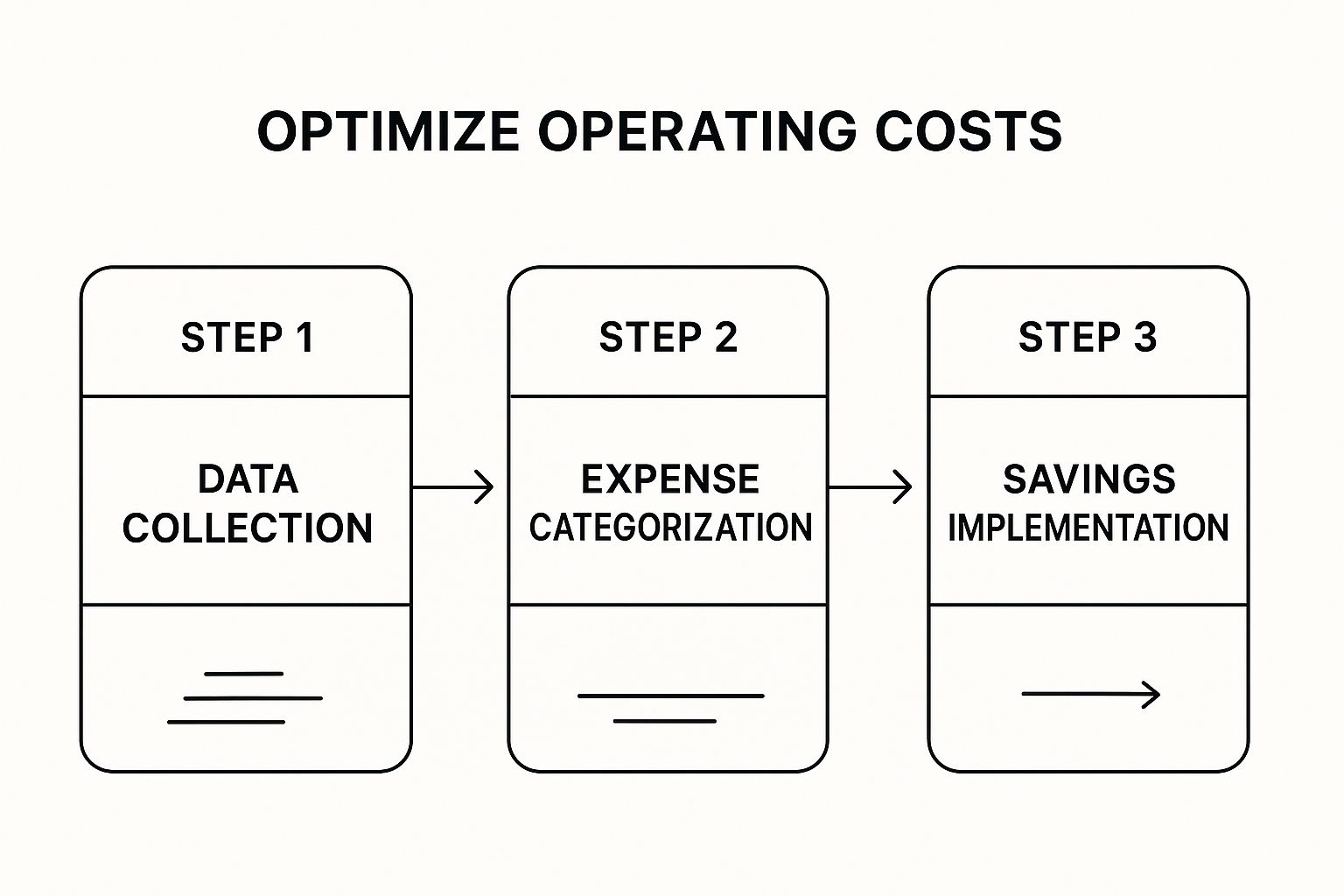

This whole process is about turning that raw financial data into a concrete plan for savings.

It’s a repeatable cycle: gather the data, sort it out, find the waste, and act on it. Simple, but incredibly powerful.

Categorizing Your Expenses for Clarity

Once you have all your expense data in one place, the real work begins. You need to sort everything into meaningful buckets. This brings immediate clarity and helps you decide where to cut without accidentally hurting your growth. A straightforward way to do this is by using three categories:

- Essential Costs: These are the non-negotiables—the expenses that keep the lights on. Think server hosting, core team salaries, and critical compliance software.

- Growth-Oriented Costs: This is where you put your strategic investments. It includes things like marketing campaigns, sales commissions, and R&D for new features.

- Wasteful Costs: These are the expenses that deliver little to no real value. We’re talking about unused software licenses, redundant tools, or ad campaigns with terrible ROI.

Doing this forces you to justify every single line item. For instance, a marketing campaign might feel like a growth cost, but if its customer acquisition cost is through the roof, it’s probably bleeding into the wasteful category. If you need a hand with that, check out our guide on how to calculate your SaaS customer acquisition cost to get a much better grip on your marketing efficiency.

Performing a Tech Stack and Vendor Audit

Your tech stack is almost always a goldmine for hidden savings. In the rush to build and scale, SaaS startups tend to collect subscriptions like souvenirs. A thorough audit isn't just a good idea; it's essential.

Start by making a master list of every single subscription your company pays for. Then, for each one, ask a few tough questions:

- Who actually uses this?

- What critical job does it do for us?

- Do we already have another tool that does the same thing?

- Are we paying for a plan that’s way more than we need?

I once helped a startup find they were paying for 15 unused seats on a project management platform. It was costing them over $2,000 a year for nothing. That’s a simple fix that came from just asking the right questions.

Don’t forget to scrutinize your vendor contracts, too. When renewal time rolls around, don’t be afraid to renegotiate. If your needs or usage have changed, there’s often room to adjust the terms. Most vendors would rather be flexible than lose a good customer.

This kind of detailed "cost mapping" transforms a spreadsheet of numbers into a clear, actionable roadmap. It’s the foundational work that makes every other cost-cutting effort genuinely effective.

Slashing Operational Overhead with Smart Automation

Let's be honest: repetitive manual tasks are a silent killer of both productivity and your budget. For any startup trying to minimize operating costs, smart automation isn't just a trendy concept; it's a core strategy for building an efficient business. It’s all about getting your talented team off the hamster wheel of tedious work so they can focus on what actually grows the company.

Just think about the daily grind in your own operations. How many hours get sunk into manually reconciling invoices, handling routine HR paperwork, or just sorting customer support tickets? Every one of those moments is a prime opportunity to automate, cut costs, and often, improve the quality of your output.

Finding the Best Places to Automate

Not all automation is created equal. You'll get the biggest bang for your buck by targeting tasks that are both time-consuming and happen over and over again. These are your "high-ROI" activities, and automating them will have a direct impact on your bottom line.

A good way to spot these opportunities is to look for work that is:

- Rule-based: The process follows a clear, predictable "if-then" logic every time.

- High-volume: Your team is doing this multiple times a day or week.

- Prone to human error: It's easy for small mistakes to slip through when people do it manually.

For instance, I’ve seen SaaS support teams spend hours just assigning new tickets to the right agent based on what the customer wrote. That's a textbook case for automation. A simple workflow can scan a new ticket for keywords like "billing" or "bug" and instantly route it to the correct department, no human touch required. This saves a ton of time and gets customers answers faster.

Automation is what shifts your team from just doing tasks to thinking strategically. Instead of managing a process, they can focus on improving it. This sparks a culture of continuous improvement that drives real cost efficiency.

Putting Automation into Practice

Once you know what to automate, you need to pick the right tools. You don't have to go all-in at once. Start small with tools like Zapier or Make to connect the apps you already use and build simple workflows. For heavier administrative work, Robotic Process Automation (RPA) can act like a "digital employee," handling data entry or pulling together reports.

Newer AI tools can handle even more complex jobs. Imagine AI-powered lead scoring that automatically surfaces your hottest prospects, or a system that analyzes customer feedback to flag emerging issues before they become major problems. If you really want to dig into the numbers and see the financial upside, check out these marketing automation ROI secrets.

The data backs this up. A McKinsey report found that companies deeply integrating AI and automation saw their operational expenses drop by as much as 30%. The biggest savings came from finance and customer service—exactly where those routine tasks tend to pile up. This kind of digital transformation is key to achieving true cost efficiency and helps you minimize operating costs where it counts.

Slash Your Customer Acquisition Costs with Referral Marketing

High customer acquisition cost (CAC) is a silent killer for SaaS startups. It quietly drains your runway while you're busy building a great product. You can pour endless cash into paid ads and see the needle barely move, but what if your best growth channel is already right under your nose?

I'm talking about your existing happy customers. Turning them into a dedicated, word-of-mouth sales force is one of the smartest financial moves you can make. A solid referral program isn't just a gimmick for a few extra signups; it's a blueprint for a self-powering growth engine that brings in high-quality leads for a tiny fraction of what you're paying now.

Designing Referral Offers People Actually Want

The secret to a referral program that works is an offer so good it feels like a no-brainer. Your reward has to be genuinely motivating, something that makes your customer want to share. Forget one-size-fits-all incentives; those almost never land. You have to get inside your users' heads and figure out what they'd truly value.

From my experience, a few incentive models work wonders for SaaS:

- Feature Unlocks: Give them a taste of a premium feature or bump them up a plan tier. The cost to you is minimal, but the perceived value is huge. Plus, it gets them more invested in your product.

- Account Credits: A straightforward discount on their next bill is a tangible reward they can immediately appreciate. It’s a direct thank you that reinforces the value of sticking around.

- Good Old-Fashioned Cash: Never underestimate the power of a direct cash payment, especially if your customer lifetime value (LTV) supports it. It's simple and universally appealing.

- The "Win-Win" (Dual-Sided): This is my personal favorite. Reward both the person referring and the new friend who signs up. This structure makes your customers feel like they're giving a gift, not just shilling for you.

You’re aiming for an offer so compelling that sharing feels like a smart, helpful act. If you're looking to get a bit more creative, there are plenty of unique referral marketing ideas that can set you apart.

Spreading the Word Without Being Annoying

Okay, you've got a killer offer. Now what? You have to let people know it exists. The key is to weave your promotion into the user experience naturally, catching people when they’re feeling most positive about your product.

Think about those "magic moments." Maybe it's right after a user exports their first big report or successfully integrates another tool. A small, polite banner that says, "Love what you just did? Share us with a friend, and you both get a month free!" can work incredibly well.

When you're brainstorming ways to slash your marketing spend, understanding the power of referral programs is essential. You're tapping into the most potent marketing force there is: genuine trust between peers.

Let's be real—people trust recommendations from friends infinitely more than they trust an ad. The bonus? Customers who come from referrals tend to stick around longer and have a higher LTV, which means more profit for you.

How to Track Performance and Prove It's Working

To truly grasp how referrals help minimize operating costs, you absolutely must track performance. And I don't just mean counting signups. You need to put your referral CAC head-to-head against your other channels, like paid search or social media.

This is where a tool like Refgrow becomes invaluable. Its dashboard does the heavy lifting, showing you exactly who is referring, what you're spending on rewards, and most importantly, your effective CAC for the channel.

When the data shows your referral CAC is 50%, or even 70% lower than your paid ad CAC, the lightbulb goes on. That's the moment your referral program transforms from a "nice-to-have" marketing tactic into a core pillar of your financial strategy.

When to Bring in Specialized Cost Reduction Services

While running internal audits and automating workflows are fantastic first steps, there comes a point when you need to call in the specialists. I know, it feels a bit backward to spend money to save money. But the right cost reduction service can uncover savings your team—deep in the trenches of day-to-day operations—might never find.

These firms bring a completely fresh set of eyes. They aren't attached to your current tools or vendors, so there are no internal biases to worry about. Their entire job is to dig into your spending, find hidden inefficiencies, and then go to bat for you with their deep data analysis and sharp negotiation skills.

What Do These Cost Reduction Partners Actually Do?

A good cost reduction service won’t just send you a PDF report and disappear. It's a hands-on, results-driven partnership. They dive deep into the specific areas where startups tend to bleed cash without even noticing.

Typically, their work zeroes in on a few key functions:

- Vendor Contract Renegotiation: They’ll pore over your contracts for SaaS tools, cloud hosting, and other recurring services. Armed with market data, they negotiate better rates on your behalf.

- Supply Chain Optimization: If your business deals with physical products, they can untangle your logistics and find ways to slash procurement costs.

- Process Inefficiency Audits: They map out your internal workflows, spotting the bottlenecks and wasteful steps that inflate your operational overhead.

Think of them as financial detectives. They have a sixth sense for finding those "we've always done it this way" processes that are secretly draining your bank account.

The real value of an outside expert is their ability to see the forest for the trees. An internal team might be too close to a process to recognize its flaws, whereas a specialist can immediately identify where the value leaks are happening.

Is It the Right Time for Your Startup?

So, how do you know when to make the call? It usually comes down to complexity and opportunity cost. If your team is burning too much time managing vendor relationships, or if your monthly operational spend has become a tangled mess of subscriptions, it might be time.

You're not alone in considering it. The demand for these services is exploding. The cost reduction services market, valued at around USD 123.6 million in 2025, is projected to more than double to USD 242.4 million by 2032. This isn't just a trend; it's a reflection of how critical expert help has become for trimming business expenses.

Of course, while these services tackle vendor costs, don't forget that your internal growth strategies, like referral marketing, are just as important for a healthy bottom line. For some solid advice on that front, check out our guide on referral program best practices.

At the end of the day, hiring a cost reduction service is a strategic investment. By finding savings that far outweigh their fees, they deliver a powerful return and give your team back its most precious resource: time.

Cutting Costs: Your Questions Answered

When you're trying to manage your startup's finances, a lot of questions pop up. Answering them correctly is the difference between making smart cuts and accidentally kneecapping your growth. Let's dig into some of the most common questions I hear from founders.

How Often Should We Really Be Reviewing Our Expenses?

Don't wait for the end-of-year tax panic. For a startup that's moving quickly, you need to be on top of your expenses monthly.

A monthly check-in is frequent enough to spot things like a new software subscription that's not being used or a sudden spike in your cloud bill before they turn into major cash drains. If you absolutely can't manage monthly, a quarterly review is the bare minimum.

Get it on the calendar as a recurring meeting with your key team members. This isn't just about staring at a spreadsheet; it's a strategic huddle. The big question to ask for every line item is: "Is this still giving us the value we thought it would?" Treat it with the same seriousness you give your product roadmap meetings.

We Need to Save Money Now. Where Do We Start?

When you need to make cuts, go for the low-hanging fruit first—the things that won't mess with your core operations or slow down product development. I've found the best places to look first are almost always the same.

Start here:

- Software Graveyard: Do a full audit of every single tool you pay for. It’s incredibly common to find that 10-20% of your software licenses are assigned to people who are no longer with the company or aren't even using the tool.

- Marketing Budget: Take a hard look at your ad campaigns. Are you pouring money into channels with a sky-high Customer Acquisition Cost (CAC) and minimal conversions? Pause them. Reallocate that cash to what's already working.

- Tool Overlap: Are you paying for two different project management platforms? Multiple cloud storage providers? Consolidating these can save you money instantly.

The initial goal is simple: stop the bleeding without performing open-heart surgery on your business. Focus on obvious waste before you even consider touching the expenses that are essential for growth.

How Do We Cut Costs Without Killing Our Growth?

This is the classic startup tightrope walk. Cut too deep, and you risk starving the very parts of the business that bring in revenue. The trick is learning to see the difference between a "cost" and an "investment."

An investment is an expense you expect a clear, measurable return from. Think of a high-performing marketing channel or a crucial engineering hire. A cost, on the other hand, is just the price of keeping the lights on—like office rent or utilities.

When you have to minimize operating costs, focus on making your investments more efficient, not just slashing them. For instance, instead of killing your marketing budget, maybe you shift spending from expensive paid ads to a lower-cost, higher-ROI referral program. This way, you protect your growth engine while still getting your finances in order.

Ready to slash your customer acquisition costs and build a sustainable growth engine? With Refgrow, you can launch a fully native referral program in minutes. Stop overspending on ads and turn your happy customers into your most powerful sales team. Get started with Refgrow today.