Calculating sales commission is straightforward in its most basic form. You simply multiply the commission rate by the total sale amount. For example, if a salesperson closes a $10,000 deal and their commission rate is 5%, their payout is $500 ($10,000 x 0.05). This is the fundamental math that underpins almost every commission model out there.

Why Your Sales Commission Structure Matters

Before you even touch a calculator, it’s crucial to step back and think about the why behind your commission plan. This isn't just about cutting checks for your team. A well-crafted commission structure is one of the most powerful strategic tools you have for driving specific business outcomes. It directly shapes sales behavior and aligns what your team wants with what the company needs.

A great commission plan does so much more than reward a closed deal. You can fine-tune it to hit very specific targets. Want to push higher-margin products? Or maybe you need to acquire more net-new customers? How about breaking into a new market? The structure you build sends a crystal-clear message to your team about what truly matters.

Connecting Incentives to Business Goals

Think of your commission plan as the playbook for your sales team. It's the compensation structure that guides their daily activities toward the actions that are most valuable for the business. Different models are built for different purposes, and knowing the difference is what separates a good sales engine from a great one.

When you're designing your plan, you need to have a few things straight:

- Business Objectives: What’s the number one goal right now? Is it explosive revenue growth, better profitability, or grabbing more market share? Your plan has to mirror that primary objective.

- Sales Cycle Length: A long, complex sales cycle often calls for a model with a healthier base salary to keep reps stable. On the other hand, a short, transactional cycle can work wonders with a much higher variable pay component.

- Team Experience: A plan for a team of seasoned pros will look totally different from one you’d design for junior reps who need more security while they're still learning the ropes.

A thoughtfully designed sales commission plan is one of the most effective tools for translating high-level business strategy into concrete, on-the-ground action from your sales force.

It's also worth noting that modern sales strategies often blend direct sales with other growth channels. You can learn more about managing these partner-based programs by looking into different types of referral tracking software, which frequently works hand-in-hand with direct sales commission plans. The goal is to build a complete incentive system that drives the right behaviors across every single one of your revenue streams.

Choosing the Right Sales Commission Model

Picking the right way to pay your sales team is more than just a math problem—it’s a strategic lever. Get it right, and you’ll fire up your team and drive the exact behaviors you want. Get it wrong, and you could end up incentivizing the wrong things entirely. There’s no single "best" model; the key is to find the one that aligns with your specific goals, whether that's rapid market expansion, boosting profit margins, or fostering better teamwork.

The most aggressive approach you can take is the Straight Commission model. Here, a salesperson’s entire paycheck comes from the deals they close. No base salary, just pure, performance-based pay. It’s a high-risk, high-reward structure that works wonders in industries with big-ticket items like real estate or for companies where reps can close deals fast.

Of course, not everyone thrives on that kind of pressure. That’s why the Base Salary Plus Commission model is so popular. It offers reps a safety net with a guaranteed base salary but still dangles a carrot to reward top performance. This balanced approach helps attract experienced talent who might shy away from a 100% commission role, ultimately reducing burnout and turnover.

Differentiating Your Incentive Structures

Beyond those two common models, you can get a lot more creative to target specific outcomes and reward your reps with more precision.

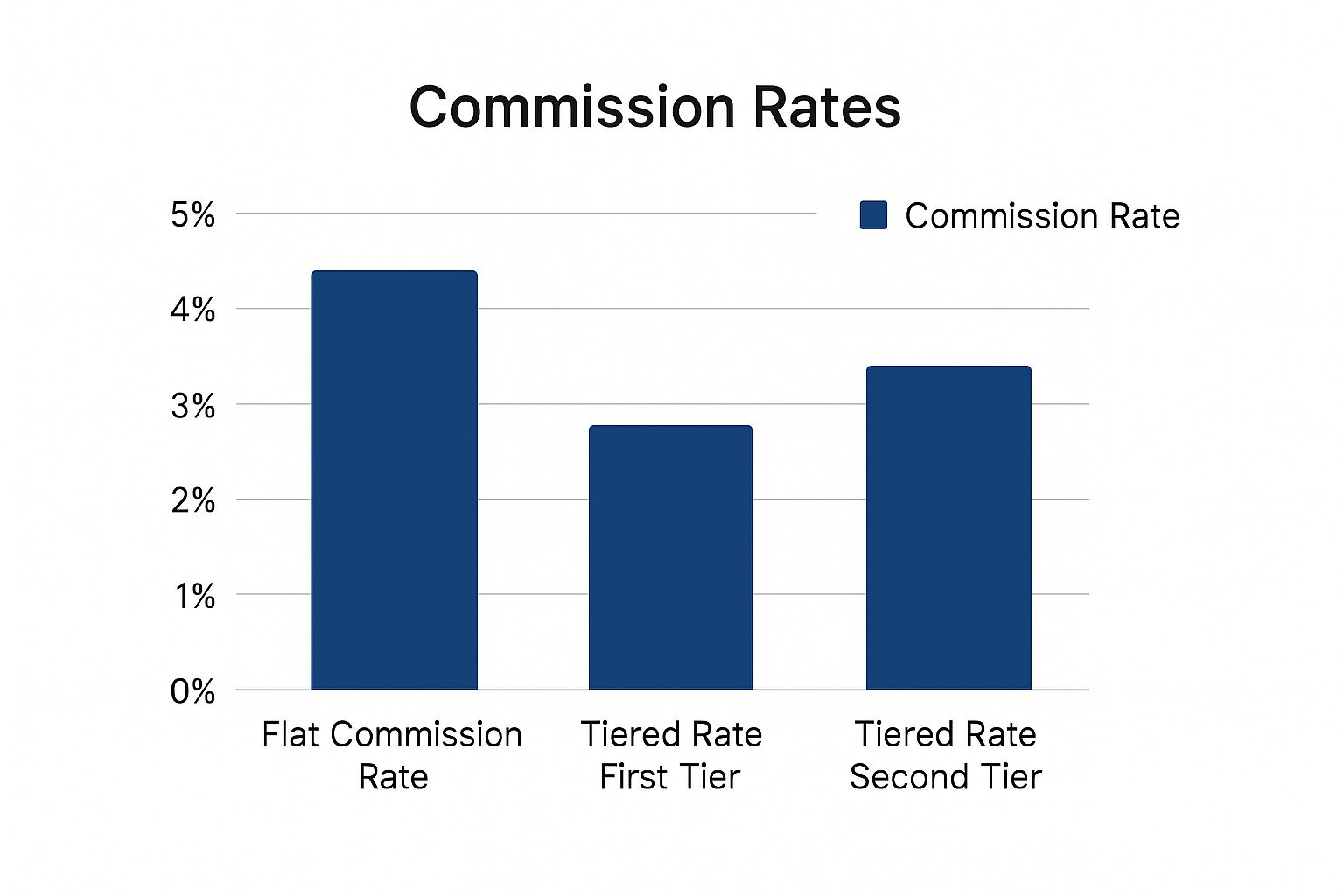

Tiered Commission: This is all about motivating reps to blow past their quotas. For example, a rep might earn 3% on sales up to $50,000. But once they cross that line, the rate might jump to 5% on everything they sell afterward. It’s a powerful way to encourage reps to not just hit their goals, but to absolutely crush them.

Gross Margin Commission: If profitability is your north star, this is the model for you. Instead of paying a percentage of the total sale, you calculate commission based on the profit of each deal (Sale Price - Cost of Goods Sold). This immediately discourages reps from handing out deep discounts just to close a sale and aligns them perfectly with the company's financial health.

Territory Volume Commission: For businesses where teamwork makes the dream work, this model is fantastic. Commission is based on the total sales of an entire team within a specific region or market segment. It naturally fosters collaboration because everyone’s success is tied together, reducing internal competition.

The right commission model acts as a compass for your sales team, guiding them toward the activities that create the most value for your business. Choosing correctly means aligning individual motivation with strategic company objectives.

The table below breaks down these popular models, giving you a quick look at what they incentivize and where they might fall short.

Comparing Popular Sales Commission Models

| Model Type | Primary Incentive | Best For | Potential Drawback |

|---|---|---|---|

| Straight Commission | Closing a high volume or value of deals. | Aggressive growth, short sales cycles, high-ticket items. | High risk for reps, can lead to high turnover. |

| Base Salary + Commission | Consistent performance and long-term relationship building. | Most B2B/SaaS companies, roles needing industry expertise. | May attract less risk-tolerant reps. |

| Tiered Commission | Exceeding sales quotas by a significant margin. | High-growth companies aiming to motivate top performers. | Can feel demotivating if tiers are set too high. |

| Gross Margin Commission | Protecting profitability and discouraging discounts. | Businesses with variable product costs or tight margins. | More complex to calculate and track. |

| Territory Volume Commission | Team collaboration and shared success. | Mature markets or when team selling is crucial. | Can allow low-performers to coast on the team's effort. |

Each of these structures has its place. The trick is understanding your team, your market, and what you're ultimately trying to achieve.

As the chart below shows, a structure like a tiered commission plan can dramatically increase the earning potential for your top performers compared to a simple flat rate.

You can see that while a tiered system might start with a lower base rate, it quickly outpaces a flat rate, generously rewarding reps who drive the most sales volume.

Ultimately, typical sales commission rates for 2025 will continue to vary widely by industry. They're heavily influenced by things like product complexity, the length of the sales cycle, and customer lifetime value. For instance, SaaS commissions often land between 5% to 15% because of recurring revenue, while real estate agents usually earn 5% to 6% on a straight commission. In retail, where margins are thinner, commissions are much lower, typically around 1% to 5%. You can explore more detailed industry commission benchmarks on kennect.io to see how your plan stacks up.

Commission Formulas and Real-World Examples

Alright, let's get down to brass tacks. Theory is great, but seeing how the numbers actually play out is where the real understanding clicks into place. You can talk about different commission models all day, but unless you can confidently calculate sales commission for each one, it’s all just talk.

So, let's walk through the essential formulas and, more importantly, apply them to situations your sales team will actually face.

The most common starting point is the revenue commission formula. It's the bread and butter of sales compensation—simple, direct, and perfect for plans focused on hitting a top-line revenue number.

The formula itself is as straightforward as it gets:

Total Sale Amount x Commission Rate = Commission Payout

This simplicity is its greatest strength. Reps can quickly figure out what a deal is worth to them, which keeps things transparent and keeps them motivated.

Calculating Standard Revenue Commission

Let's put this formula to work. Imagine you have a sales development representative (SDR) at a SaaS company. They've just closed a brand new annual subscription worth $12,000. Your company's plan is simple: a flat 8% commission on all new business.

Here’s how the math breaks down:

- Sale Amount: $12,000

- Commission Rate: 8% (or 0.08 in your calculator)

- Calculation: $12,000 x 0.08 = $960

Just like that, the SDR has earned a $960 commission for that deal. This direct link between a specific action and a specific reward is incredibly powerful, especially for roles laser-focused on acquiring new customers.

Pro Tip: Always be crystal clear on whether commission is paid on Total Contract Value (TCV) or Annual Contract Value (ACV). For multi-year deals, that one detail can dramatically change a rep's payout and when they receive it.

Working with Tiered Commission Rates

Tiered commission structures are where things get more interesting. This is how you really light a fire under your top performers, encouraging them to blow past their quotas instead of coasting once they've hit their number.

Let's say your top account executive, Maria, has a monthly quota of $100,000. Her comp plan uses tiers to reward overachievement:

- Tier 1: 7% on all sales up to her quota ($0 - $100,000)

- Tier 2: 10% on all sales above her quota (anything over $100,000)

This month, Maria crushed it, bringing in $150,000 in new deals. To figure out her total commission, you have to calculate each tier separately.

First, you calculate her commission on the sales that got her to her quota:

- $100,000 (sales within Tier 1) x 7% = $7,000

Next, you calculate her commission on the amount she sold past her quota. That's $150,000 - $100,000 = $50,000. This portion gets the higher rate.

- $50,000 (sales within Tier 2) x 10% = $5,000

Finally, you just add the two amounts together for her total earnings:

- $7,000 (from Tier 1) + $5,000 (from Tier 2) = $12,000

Maria’s total take-home commission for the month is a cool $12,000. That accelerator for exceeding her goal gave her a massive earnings boost and handsomely rewarded her for pushing so hard.

Figuring Out Gross Margin Commissions

Sometimes, raw revenue isn't the most important metric. When profitability is the name of the game, a gross margin commission model is your best friend. It’s brilliant because it forces salespeople to protect the health of the deal, not just chase the biggest top-line number. In other words, it discourages deep, unnecessary discounting.

The formula for this one is:

(Sale Price – Cost of Goods Sold) x Commission Rate = Commission Payout

Let's take a rep at a manufacturing company selling custom equipment. They close a deal for $50,000. The direct cost to make and deliver that equipment (the Cost of Goods Sold, or COGS) is $30,000. The rep earns a 20% commission on the profit.

Here’s the breakdown:

- First, find the profit (Gross Margin): $50,000 (Sale Price) - $30,000 (COGS) = $20,000

- Then, calculate the commission on that profit: $20,000 (Gross Margin) x 20% (Commission Rate) = $4,000

The rep walks away with a $4,000 commission. Now, consider what would have happened if they'd panicked and discounted the price to $45,000 to close it faster. The gross margin would shrink to $15,000, and their commission would plummet to just $3,000. This model perfectly aligns their wallet with the company's need for profitable deals.

Fine-Tuning Your Commission Plan with Advanced Strategies

https://www.youtube.com/embed/olrl8uP-ZOU

Once you've got the basics down, it's time to elevate your commission plan from functional to fantastic. This is where we move beyond the simple math of how to calculate sales commission and start thinking strategically. The real magic happens when you use your compensation plan to shape behavior, support your team, and hit very specific business goals.

Think of these refinements as turning your plan from a simple paycheck calculator into a powerful engine for long-term growth.

A great place to start is with your newest hires. Nothing supports a new salesperson better than a commission draw. Essentially, a draw is an advance on future commissions. It provides a steady income while they're still building their pipeline and learning the ropes. This is an absolute game-changer in industries with long sales cycles where a rep might not see their first commission check for months.

You'll generally see two flavors of commission draws:

- Recoverable Draw: This works like a loan. You advance the rep a certain amount of money. As they start earning commissions, those earnings first go toward "paying back" the draw. If they leave the company before earning enough to cover it, they might owe the remaining balance.

- Non-Recoverable Draw: This is closer to a guaranteed salary for a defined period. The rep gets the payment, and there’s no obligation to pay it back if their earned commissions don't cover the full amount. It’s far less risky for the salesperson and can be a huge selling point when you're trying to attract top talent.

Fueling Peak Performance and Strategic Goals

Supporting new reps is one thing, but how do you keep your seasoned veterans motivated and focused on what matters most right now? That's where accelerators and kickers come into play.

Accelerators are like tiered commissions on steroids. They kick in after a rep hits 100% of their quota. For instance, a rep might earn an 8% commission on all sales up to their quota. But for every single dollar they bring in after hitting that target, their rate jumps to 12%. This is a powerful way to kill any "coasting" behavior once a quota is met.

Kickers are entirely different. They are short-term, laser-focused bonuses. Let's say you're launching a new software module and want to build momentum this quarter. You could offer a $500 kicker for every single deal that includes the new module. It's a direct, immediate, and highly effective incentive.

A well-designed plan doesn't just pay for performance—it actively creates it. By using draws to build a stable foundation and accelerators to reward overachievement, you build a system that supports, motivates, and retains top talent.

When you're refining your plan, always be thinking about how these incentives can encourage behaviors that help the whole company. For example, structuring kickers around increasing average order value can have a massive impact on your bottom line.

Aligning Payouts with Business Reality

The "when" and "how" of your payouts are just as critical as the commission rates themselves. You need crystal-clear rules for when a commission is officially earned. Is it when the customer signs the contract? Or is it when the company receives the first payment? Getting this right from the start prevents disputes and builds a culture of trust.

The same goes for recurring revenue. If a rep sells a subscription, how long do they earn a commission on it? Just the first year? Or for the entire life of the customer? There's no single right answer, but you need to define it.

These advanced strategies aren't just for internal teams, either. Many of these principles can be adapted for partner programs. To see how similar incentive structures can drive growth through external channels, take a look at our guide on affiliate marketing strategies.

Common Commission Plan Mistakes and How to Avoid Them

Even with the best intentions, a commission plan can go sideways if you're not careful. When you calculate sales commission, it’s the structure behind the numbers that really steers your team's behavior. Little oversights can turn into big headaches, from frustrated reps to missed company targets. Getting it right means knowing which common—and costly—pitfalls to sidestep.

One of the most frequent mistakes I see is setting unrealistic quotas. When targets feel impossible to reach, motivation craters. It’s human nature. If your reps feel like they have no shot at winning, they’ll eventually stop putting in the extra effort, leading to burnout and a revolving door of talent. A plan that demotivates is actually worse than having no plan at all.

This kind of burnout absolutely crushes retention. When your best people walk away because they feel the game is rigged, you don't just lose their revenue. You're also stuck with the massive cost of recruiting and training their replacements. For a deeper dive into this, you can explore some great strategies on how to reduce churn rate on your sales team.

Keeping Your Commission Rules Simple

Another huge pitfall is making the rules way too complicated. If your team needs an advanced degree to figure out their paycheck, you’ve created a system built on confusion, not motivation. Complex plans just breed distrust and make reps waste precious time decoding their pay instead of selling.

Your plan should be so straightforward that a brand-new hire can grasp it in five minutes. Simplicity is key. It ensures every single rep knows exactly what actions will lead to a bigger check, which naturally aligns their daily work with your biggest business goals.

The Problem with Capping Commissions

Capping commissions is one of the most self-defeating mistakes you can make. Putting a ceiling on what your people can earn sends a terrible message to your top performers: "Thanks for the great work, but please stop now." It actively punishes overachievement and gives your superstars a reason to hit the brakes once they reach their cap.

Capping commissions is a classic case of being penny-wise and pound-foolish. Sure, you might save a little on payouts, but you lose a fortune in potential revenue and risk pushing your best talent straight to competitors who will reward them without limits.

Finally, make sure your incentive structure is competitive within your industry. What works in one field doesn't work in another. For instance, looking at average sales commission rates in 2025, you'll see a lot of variation. Retail might hover around 1% to 5%, while something like financial services can go from 5% all the way up to 20% for complex products. Commissions in manufacturing often land somewhere between 2% and 10%.

Knowing these benchmarks is critical. If your rates are out of sync with industry standards, you’ll struggle to attract and keep skilled salespeople who know exactly what they're worth on the open market. For more on this, check out the benchmarks over at IncentiveSolutions.com.

Frequently Asked Questions About Sales Commission

Even with the most carefully designed commission plan, questions are going to pop up. When it's time to actually calculate sales commission, the little details about timing, disagreements, and specific terms can make all the difference in maintaining trust with your team. Let's walk through some of the most common questions I've seen from both leaders and reps over the years.

One of the first things people want to know is when they'll get paid. Should commissions be paid out monthly, quarterly, or on another schedule? There isn't a single correct answer, but I've found that monthly payouts are often the most effective. They give reps a more immediate reward for their hard work, which directly connects their performance to their paycheck and keeps motivation high.

Quarterly payouts might make sense for jobs with incredibly long sales cycles, but that delay can sometimes weaken the incentive. Whatever cadence you land on, make sure it’s spelled out clearly in your commission agreement.

Draws, Disputes, and Payout Triggers

Commission draws are another area that can be a bit confusing. We touched on them earlier, but it’s worth highlighting the two main types you’ll encounter.

- Recoverable Draw: Think of this as an advance on future commissions. The company gives the salesperson a set amount of money, which is then "repaid" from the commissions they earn down the line. If a rep leaves while still in the red, they might have to pay that balance back.

- Non-Recoverable Draw: This is closer to a guaranteed base salary for a set period. The rep gets the money with no strings attached and doesn't have to pay it back if their earned commissions don't cover it. It’s much lower risk for the employee and can be a great tool for recruiting top talent.

The single most important thing you can do to prevent disputes is to have a crystal-clear, legally-vetted commission plan in writing. Ambiguity is the absolute enemy of a fair comp plan. Spell everything out from the start to protect both the company and the salesperson.

So what happens when a dispute does arise? Your first move should always be to go back to the signed commission agreement. If the terms are clear, the answer should be right there. If the language is vague, set up a one-on-one meeting to listen to the rep's perspective and review all the deal data together. The goal should always be to find a fair solution that preserves the relationship.

Finally, there's the age-old debate: do you pay commission when the deal is signed, or when the customer actually pays their invoice? Paying on a signed contract is a huge motivator for reps, but it puts the company at risk if that client ends up not paying.

A popular and effective middle ground is to pay 50% of the commission when the contract is signed and the final 50% when the first payment comes through. This approach gives the rep an immediate win while protecting the company's cash flow.

Ready to stop wrestling with spreadsheets and build a referral program that runs itself? With Refgrow, you can launch a fully native affiliate platform inside your SaaS product in minutes. Automate tracking, manage payouts, and connect with a network of active affiliates instantly. Learn more and get started at Refgrow.